Bond People, Stock People & Reality

“He asked if he had any money; Don Quixote replied that he did not have a copper blanca, because he never had read in the stories of knights errant that any of them ever carried money. To this, the innkeeper replied that he was deceived, for if this was not written in the histories, it was because it had not seemed necessary to the authors to write down something as obvious and necessary as carrying money and … therefore should be taken as true and beyond dispute that all the knights-errant who fill so many books to overflowing carried well-provisioned purses for whatever might befall them…”. Don Quixote, Cervantes, 1605.

The facts are indisputable. How to interpret them is not.

Here are the facts:

Geopolitically, there are hot wars in Europe and the Middle East. Power is dispersed and everyone is playing off each other. The US is (appropriately) protesting war crimes in Ukraine and Israel but is willing to do business with Saudi and Venezuela when necessary. China sees itself as a global leader but supports Iran, Hamas, and Russia. Israel won’t support Ukraine if Russia won’t arm Hezbollah. Wars create a) uncertainty and b) redirect capital away toward government borrowing and the military-industrial complex. This diffuse power also makes it particularly hard to deal with climate change, a global problem requiring intricate coordination and, by the way, a lot of borrowing.

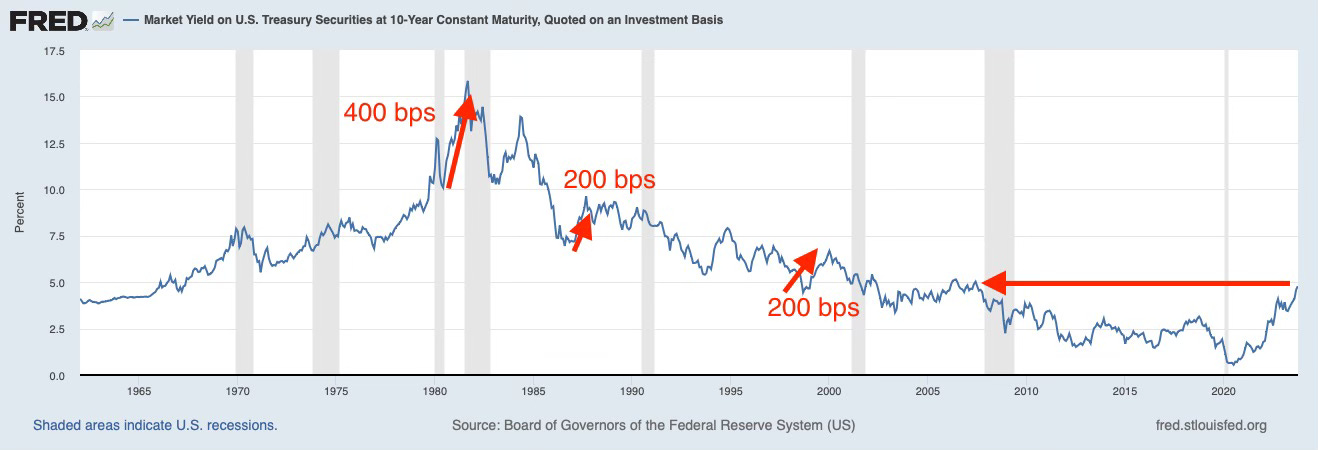

The turbulent geopolitical backdrop is overlaid on a turbulent financial backdrop. Growth is weakening in most places in the world, though the US is still doing OK. Inflation that had been high is gradually falling to normal but is not back to normal yet. Monetary conditions are tight and getting tighter as central banks let their balance sheets shrink and bond yields rise. Bond yields are up 400 bps from their lows and real yields are up 300 bps. This is among the worst bond selloffs in history.

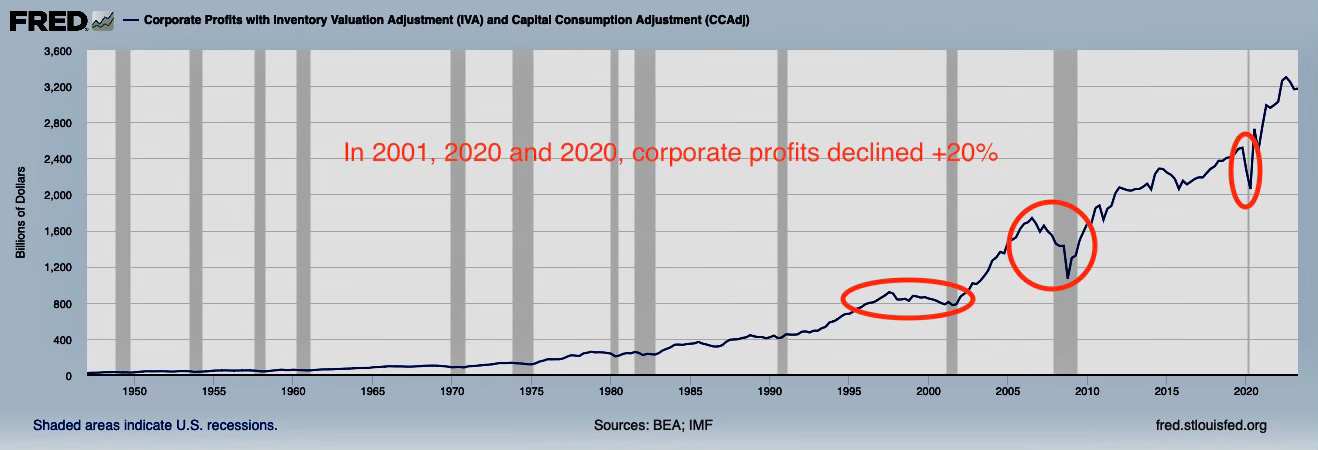

As a result, the cost of credit is now prohibitively high for many borrowers and bond yields are above earnings yields for the major equity indexes. Budget deficits are large and getting larger, which is shocking given that unemployment is low. In terms of stocks, PEs on large-cap US stock indexes are well above average. At the same time, earnings are expected to grow about 10% next year and a wave of artificial intelligence is transforming companies. In a downturn, earnings typically contract.

Different people look at the same facts and arrive at different conclusions. That’s what makes a market. For simplification, let’s divide them into “equity people” and “bond people.”

Equity People

Equity people see a world of possibilities. They are by nature optimists. They believe a human being’s default mode is to innovate, work, and move forward, which leads to profits and earnings. If you own the companies engaged in such activities wisely and compound you can become rich, like Buffet. And by the way, owning stocks is tax-advantaged because as the share goes up in price, you don’t pay any taxes on that appreciation until you sell it, which might be never.