THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

The equity market is down about 2% this year, filled with stocks that US households are buying at sky high valuations. One widely held popular stock I track that recently reported meh earnings is trading at a PE (price to earnings ratio) of 56. The stock’s average historical PE is 30, meaning if the stock falls 46%...it would be nothing out of the ordinary even if it is a sound company. Now imagine that happening across many stocks all at once.

One way to think about what is going on is to ask yourself how much you’d pay for your favorite car. Say you think a Porsche is cool (that was the coolest car when I was a kid in the 1970s). Maybe a Porsche sells for $150,000 these days (my car is 11 years old, so I’m not current). It’s a great car. But you would never buy it for $500,000 no matter how good it is. That’s what’s going on with US stocks. Good companies trading for high prices.

Why are investors selling stocks? It isn’t for the normal reason, which is that the central bank is raising rates. If you look at the really nasty stock downturns—1929, 2000, 2008, 2022—the proximate cause was always tight monetary policy. This time something else is going on, chaotic tightening fiscal policy—in fact chaotic enough that it has spooked foreigners, leading to a sharp decline in the dollar. This may well accelerate, which is why I referenced 1998 in the title, one of the most chaotic periods for exchange rates in recent memory.

I switched from being a journalist to a trader in 1998, so it is a year I remember vividly. This period is now called the Asian financial crisis. There were a complex series of exchange rate adjustments and defaults. Back then, poorer countries (sometimes called emerging markets) had exchange rate regimes where they pegged their currency (like the Thai baht) to the US dollar. But these countries lacked the dollars to protect these pegs and once savers and speculators figured this out, the exchange rates collapsed. The point is, assets that typically moved only slowly began moving very quickly because the exchange rate regime was shifting rapidly. All exchange rates were impacted, even those countries without a peg, like the yen and as exchange rates shifted, stocks and bonds oscillated wildly. Generally stocks fell and bonds rallied. Below is a chart of the dollar versus the yen back then. It fell from 135 to 115 in three days. That’s a 15% move, small for stock investors but really big for currencies and disorderly as well.

These currencies don’t fall without a reason. They fall because investors and exporters are moving big sums of money from one place to another. Today, the question I am wondering is if foreigners who have pumped billions and billions of dollars into the US stock market begin to pull out in size. If they do, a major buyer of US stocks evaporates. For instance, European investors bought about $300 billion in US stocks last year, according to the Treasury’s International Capital System measurements.

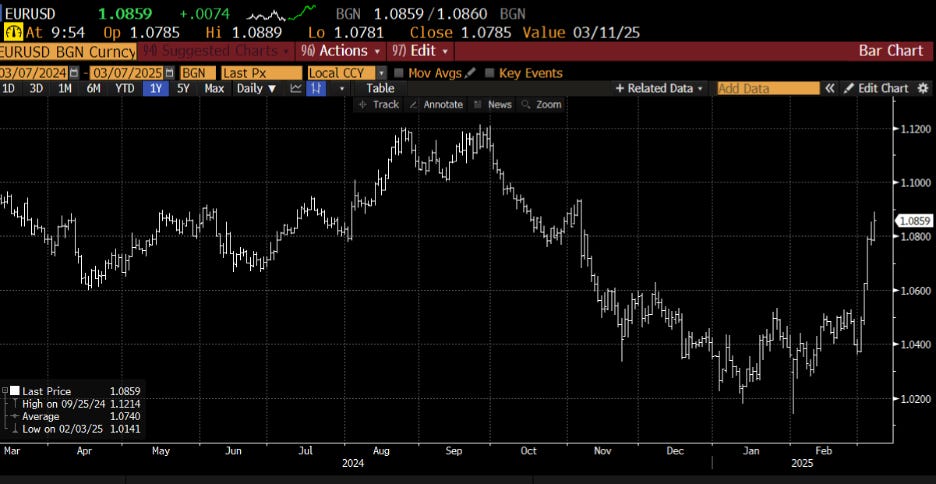

This is why the jump in the euro this week is noteworthy. US stocks are falling and the euro is rising. It seems possible that one reason US stocks are falling is that notwithstanding US households plowing every last dollar into US stocks each time stocks fall, foreigners are pulling out and selling the rallies.

They are pulling out for logical reasons. US stocks are expensive, the market is long and now there are mounting signs that the US economy is cooling fast because of the fiscal tightening. I described it as a “chaotic” fiscal tightening because the tariffs are being applied to countries with whom the US has existing treaties. So the treaties evidently aren’t worth anything. If you are a foreigner and worry tariffs are going to get applied to you and the US is effectively abandoning both military and trade treaties and becoming allied to Russia, why would you overweight US stocks?

This then sets up a self-reinforcing process of falling US risk assets and a falling dollar, which creates a challenge for the Fed. Typically, they’d cut rates when stocks are falling. But if stocks are falling because tariffs are rising, the Fed may do nothing or at least not as much as people expect them to do. Fed chief Powell acknowledged as much today. He is either tone deaf or worried about tariffs. In either case, there is no urgency to ease. That then can create meaningful additional downward pressure on US stocks. I’m was a conference this week, so less time to write than normal and late and brief note. Have a great weekend.