“The EU faces structurally higher energy and raw material costs.”

Draghi European Competitiveness Report

“We may be on the verge of a great stock market boom.”

The Alchemy of Finance, George Soros, December 1984, just before a 50% rally.

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Today, I want to talk about Europe. But before I do, a follow-up on last week’s post.

The Fed should cut 50 on Wednesday. As inflation falls below 2%, real rates are rising (because the nominal policy rate is stuck at 5.3%) when the economy is already weakening. No bueno. Getting rates 100 basis points lower fast (two 50 bps cuts) will significantly reduce the risk of much higher unemployment. But Powell has never communicated a coherent decision-making framework, so the pre-meeting communication is messy and prone to error.

A leaked (to the WSJ) and poorly sourced news story has led to an equity pop and suggested 50 is indeed possible, yet it’s also possible Fed officials use this same stock market rally to justify their timidity and only cut 25 bps. If they cut 25, the stock market will get pasted. Separately, the polls also show the US Presidential race as almost 50/50. I put my money on Harris, whose victory probably equals tighter fiscal policy. Right after the debate, Asian markets traded hard toward stocks lower, bonds higher, which is logical if you think she will raise tax rates on the wealthy.

Stepping back, we are in an up-cycle in tech and AI and a downcycle in terms of a) the economy b) fiscal and monetary policy (both of which are tightening) amid c) an increasingly dangerous war in Ukraine. This is creating a push-pull in markets. The risk of more risk-off market action is high until the Fed gets ahead of the curve and political uncertainty clears. I’ve adjusted my equity and bond positions and realize some of my shorts could get badly hurt if the Fed actually does 50. No one said investing is easy.

Europe

While I enjoy traveling in Europe, I hold 97% of my wealth outside of it. After reading Mario Draghi’s massive report on European competitiveness, the potential downside risks seem even larger than I had imagined.

European stocks trade at a fraction the cost of those in the US, but they come with huge challenges. The key things required to generate wealth are educated people, cheap energy, and cutting-edge technology. Europe struggles with all three. Against this backdrop, the rise of neo-fascist parties in Thuringia isn’t that surprising. Extremism goes hand-in-hand with economic decline.

Some of this is bad luck combined with bad policy. The European system was predicated on cheap gas. Putin has upended that model. The big difference between people now and 200 years ago is that we use energy more efficiently. It’s really that simple. We used to plow with horses, now we use massive, computer-driven tractors to reduce labor costs and figure out exactly where the seed and water should go.

By contrast, US is commodity-rich, has a lock hold on cutting-edge tech production (even if the flow is from Dutch ASML to Taiwan’s TSMC before it gets to Nvidia) and a steady flow of people from the rest of the world who want to live here.

Moreover, even as Trump tests institutions, in the US there is a coherent Federal system for laws, finance, and law enforcement. Europe lacks that. The EU competes with national authorities and there is no unified European capital market (France borrows with French bonds, Germany with German, etc.). By these metrics, China compares favorably to Europe, as the diagram I created above shows.

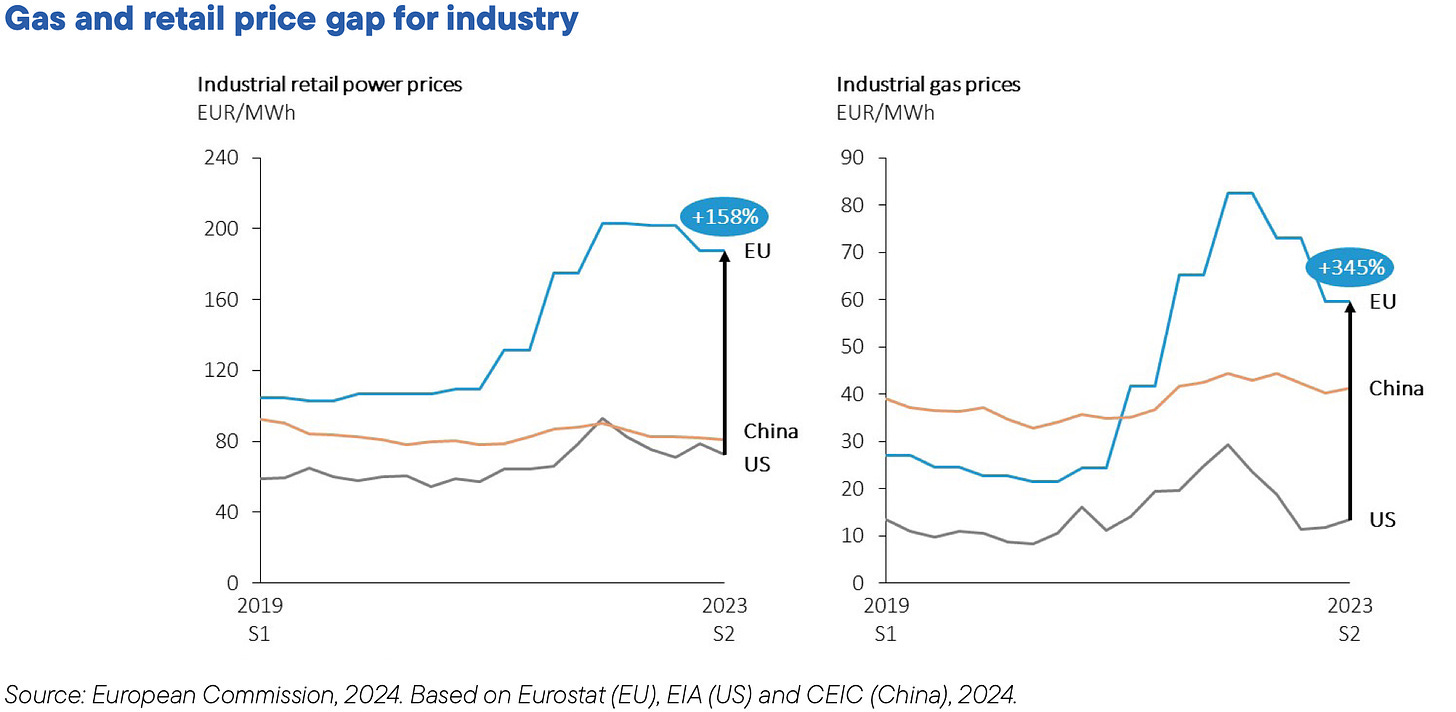

Europe is a manufacturing powerhouse, particularly for chemicals, metals, and pulp. These are all energy-intensive, meaning the Russian invasion is a disaster because it boosts the costs of inputs. Electricity costs are multiples higher than they are in the US, as the picture from Draghi’s report below shows.

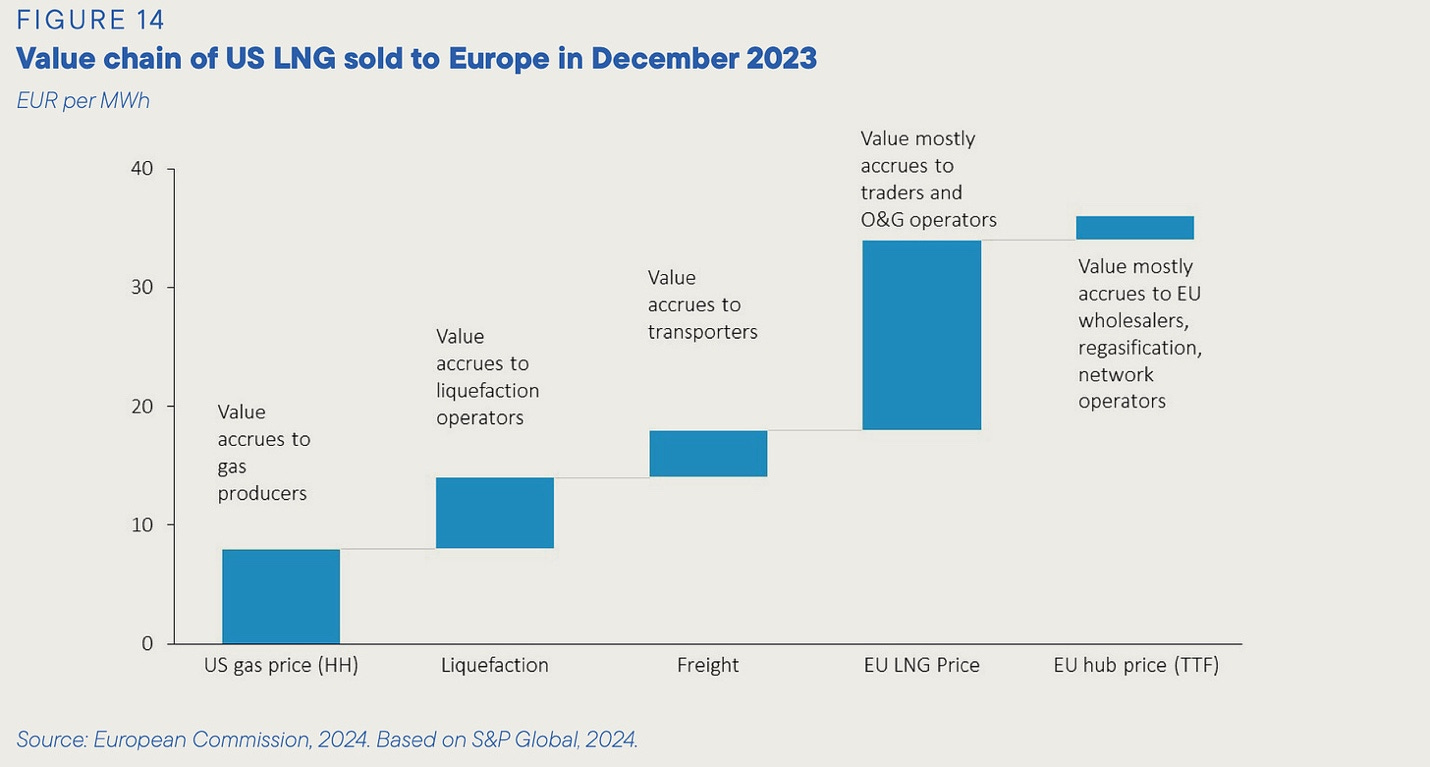

As Draghi notes, this is a windfall to gas transport companies (like Teekay Tankers).

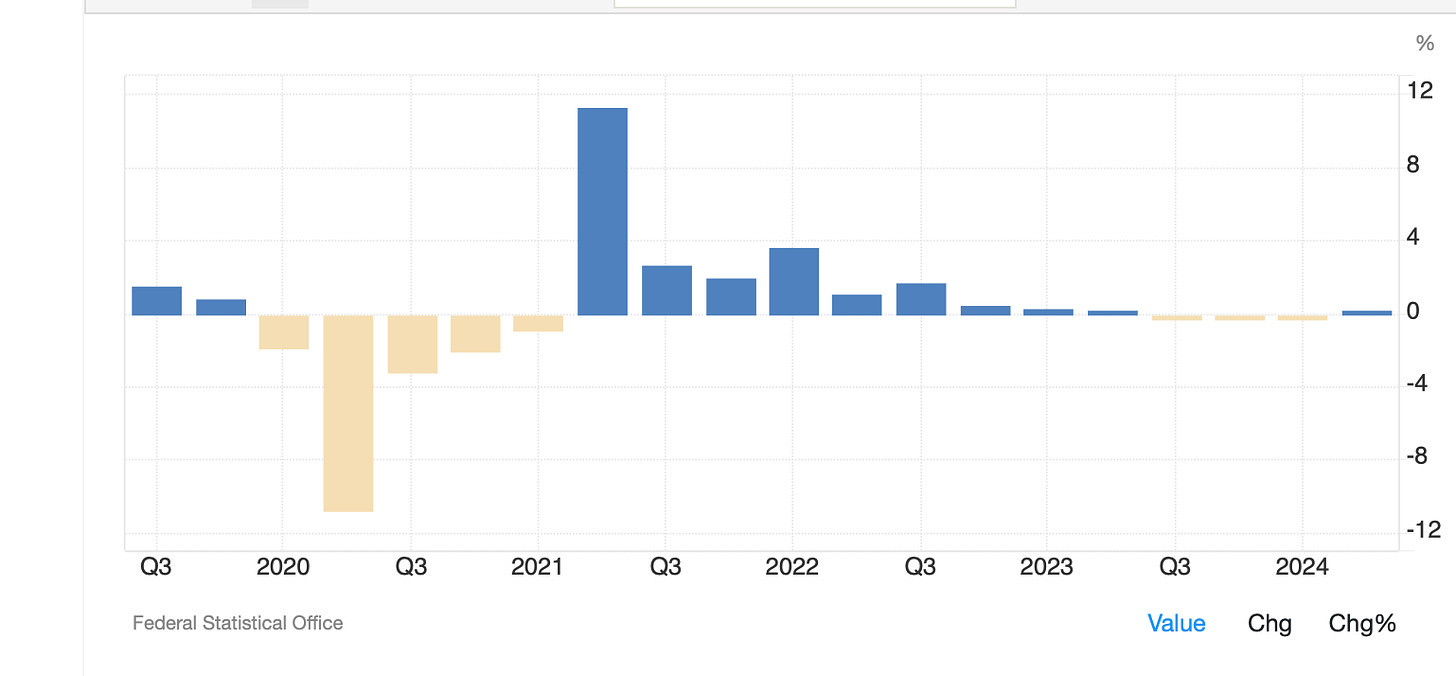

If your energy costs are high, this transfers money that could go into corporate profits and wages away from the domestic economy and to foreign middlemen. Not surprisingly, and against the backdrop of a rapid tightening, German growth has ground to a halt, as shown below, the ECB’s rate cut Thursday notwithstanding.

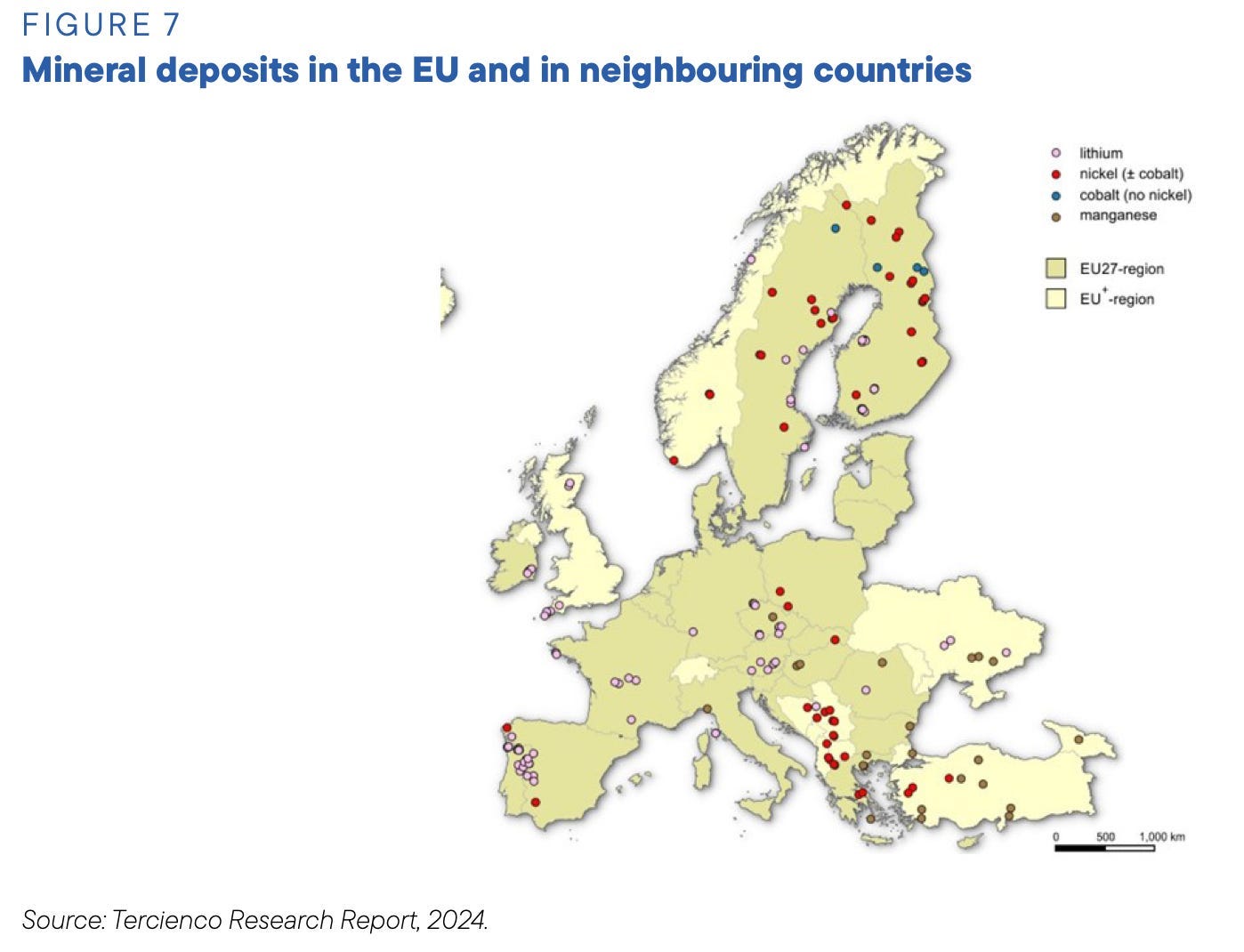

And it isn’t just natural gas that are high. The extraction and processing of commodities is almost entirely done outside of Europe. You can see how well-integrated China is to global commodities processing and why a war with them would cause a degree of chaos magnitudes worse than the one with Russia.

One of Draghi’s recommendations is to reverse this and begin developing resources that are inside Europe, which, as the image shows below, are plentiful.

Thinking this might happen, a few years ago I visited one of these sights, a big lithium deposit in Serbia. It’s a nice idea but many locals hate the idea of big industrial mines in their small countries and scenic roads, like the one below. Serbian leaders have now been trying to navigate through local opposition for years.

The absence of many leading tech in Europe is also a problem. There are a few companies that Westerners own, like Siemens or Schneider Electric, but the vast majority are avoided and trade at a steep discount. A final point that caught my attention in the report was Draghi’s remarks about defense. He is proposing a significant increase in defense spending and a Federalization of resources, which makes sense. There are not that many big European defense companies. Companies like Rheinmetall, Dassault and Thales are in the space and would stand to benefit, if the Europeans can implement the report’s recommendations, which, like a lot of other things in Brussels, could easily die in committee.

Global macro looks at the world like a puzzle. Europe is part of that. There are great companies in Europe but the overall structural challenges to the region are formidable and we can thank Draghi for making that quite clear.

Asset Allocation