The International Energy Agency predicated that demand for lithium was set to grow thirty-fold by 2030 and more than a hundred times by 2050.

The average electric car contains eighty three kilograms of copper, over three times the amount in a petrol-powered car.

-from Volt Rush, by Henry Sanderson.

I write from Santiago. Chile is home to the magic ingredients that make an electric car go—copper and lithium in particular. Outside, picture perfect weather—80 degrees, no humidity. The door is open on the balcony and I can hear the city murmur below.

Chile has the geography and climate of California and enormous potential commodity wealth. It could be a Latin Australia or Norway. But that’s not the way it is going. Demand for copper is set to lift off, but the volume of Chile’s exports is flat.1 Meanwhile, a hard left is trying to rewire the constitution and violence is on the rise.

“Don’t walk downtown,” I was told, “only park in garages, not in the street.”2 Another person told me, “he was robbed, in broad daylight, thieves literally ripped the jewelry off his neck.”

Que esta pasando?

I have multiple motivations to come here. I am researching a Master, Minion sequel, I want to talk to people directly involved in the commodity trade and I find it important to see things first hand. Ever since I studied Russian in Moscow in 1990, I try to immerse myself in the unfamiliar, like Anthony Bourdain if you replace food with money.

And if you want to follow the copper money trail, it leads here.3

Buried Treasure and Curses

Raw materials are both power and a curse. Germany in part lost the Second World War because they ran out of fuel. The desire for a greener, less oil dependent future requires a huge investment in metals that make electricity flow. Copper conducts like no other metal, except silver, which is prohibitively expensive. Places like Chile, Congo, Saudi, Russia, Norway, Australia, Canada and others that produce commodities are tethered to the fickle cycles of outside demand, particularly in the biggest economies, China and the US.

Moreover, in a boom, raw materials are such easy money they disincentivize other work. As a mine owner, your costs are fixed but your income explodes when prices rise. There is a psychological element to these disincentives, which I saw in Russia. A boom also can mechanically drive up the home currency (in this case Chilean peso), which makes non-commodity exports less competitive, what economists call Dutch disease. In Chile’s case, however, there aren’t any meaningful non-commodity exports.

Commodity riches often breed corruption. Russia is classic. So too is Congo. Based on Transparency International, Chile is about as corrupt as the US, which is an enormous accomplishment in a region with a lot of graft. Chile should be well positioned for a boom. The set up for certain commodities seems almost too obvious.

A combination of global warming, Russia’s invasion of Ukraine, mandates and subsidies in both the US and China (including Biden’s infrastructure bill) to massively boost the use of electric vehicles will create a huge rise demand for the things an electric car can’t do without—copper, lithium, nickel and cobalt. The math isn’t hard.

Ingredients of a Boom

Around 65 million cars are sold a year, of which at present only a small percent are electric. If 100% of cars were electric that would amount to roughly 250% of all copper production last year! That’s excluding the uses of copper for everything else—plumbing, building wires, phones, dishwashers, circuitry, etc. Traders call copper Dr. Copper because it is such a good predictor of industrial demand. The push to EV means copper prices explode or production increases or replacements are found or some mix of all three.

These shifts will directly impact your life. A pop higher in commodity prices is inflationary. Part of inflation is commodities themselves. The shift in prices is terrible for some companies you may own, like Tesla where higher prices cut into margins, and great for others, like metals producers.

Traders have been watching for prices to rise for some time. The pandemic and in particular China’s zero Covid put a kibosh on the nascent boom. Now it looks like things may rev up again, if the global economy doesn’t keel over after being whacked with repeated blows of rate hikes.

For context, below is the price of copper. The first big rise came in the wake of China’s post 2001 real estate boom. That boom has now gone to bust, so to get prices higher something needs to replace that demand. The most recent pop higher coincided with China ending zero Covid.

Below is the chart for lithium, which goes into batteries. Chile sells lithium to China, which then supplies car companies. Australia and China are the other big lithium producers. This chart is what a squeeze looks like, meaning prices rise inexorably because demand is high and there is no other available supply.

Geography Is Destiny

As I hurtled down the San Francisco-steep, potholed streets on my way to a dinner in the coastal town of Valparaiso, hoping I didn’t get a flat in the dangerous area, I thought about what it would be like to administer Chile. Answer: not easy. About one-quarter of this long, narrow country’s 20 million people live in Santiago, which creates a low tax base to pay for the things everyone wants—safety, smooth roads, healthcare and protected borders.

The borders are not a small issue in a region with more than its fair share of scary actors. Venezuelan gangs and others have been making inroads. Cali is here. Chile has a natural supply chain sending commodities to Europe and Asia, you can see the enormous freighters anchored off shore. How hard can it be to add some coke to the mix?

Cut off from the outside world for centuries by sea, mountains and desert, the geography might also explain why institutions here feel rickety. Political development that began hundreds of years ago in Europe relating to government administration only started here in the 19th century. Native Americans in the US got wiped out by smallpox. Here they are 13% of the population and some of them still fight on, in part protected by geography that the Spaniards could not contend with.

“Why are we not Switzerland? Because we are 3,000 years behind,” said one of my contacts. 3,000 years sounds extreme, but Chile is definitely on a different political wavelength. Historically, they have been on the receiving end of distant mandates, be it Spanish administration for hundreds of years or, now, EV mandates in Washington and Beijing.

Political Swings

The politics here are volatile. The last seventy years have seen swings from limited democracy to right-wing death squads in the 1970s and 1980s back to a fragile democracy. The current President, Boric, is a thirty-something former student protest leader. “I think that as a society we should aspire to forms of organization that go beyond capitalism,” he said in an interview with Time.4

There is plenty of historical ammunition for Boric to fire. Thousands of those suspected of Socialist sympathies were murdered under Pinochet. This period also marks one of the lowest points in the CIA, which abetted this. Past booms, going back to nitrate in the 19th century, have not trickled down. Despite sitting on top of such enormous treasure, Chile’s GDP per capita ($16k) is about 1/5 of Norway’s ($90k).

The last time I was in Santiago, I ended up mistakenly stepping between a police water canon and protesters. Following those protests, in 2021 an elected, left-leaning policy group undertook a rewrite of the Pinochet era Constitution. Their work was then rejected by voters in September. Boric had hoped the new constitution would inject a “feminist” perspective into politics. Some of what the Constitution aimed to do was social, but some of it boosted environmental protections relative to mineral production.

Codelco, the copper producer, was fully nationalized under Allende in 1971. Chile’s main lithium producer remains private but was created in part with Pinochet support. This nationalization history hangs over the industry today, something I talk about further in the subscriber only section that relates to stock valuation and supply.

Money, Luck and Uncertainty

Much of what people regard as investment prowess is luck. Take the centerpiece of most US financial advice—the merits of owning a 60% stock/40% bond portfolio. This is from Fidelity’s website: “The hypothetical 60/40 portfolio has done well over the last two decades, providing similar returns to an equities-only portfolio, with less risk.”

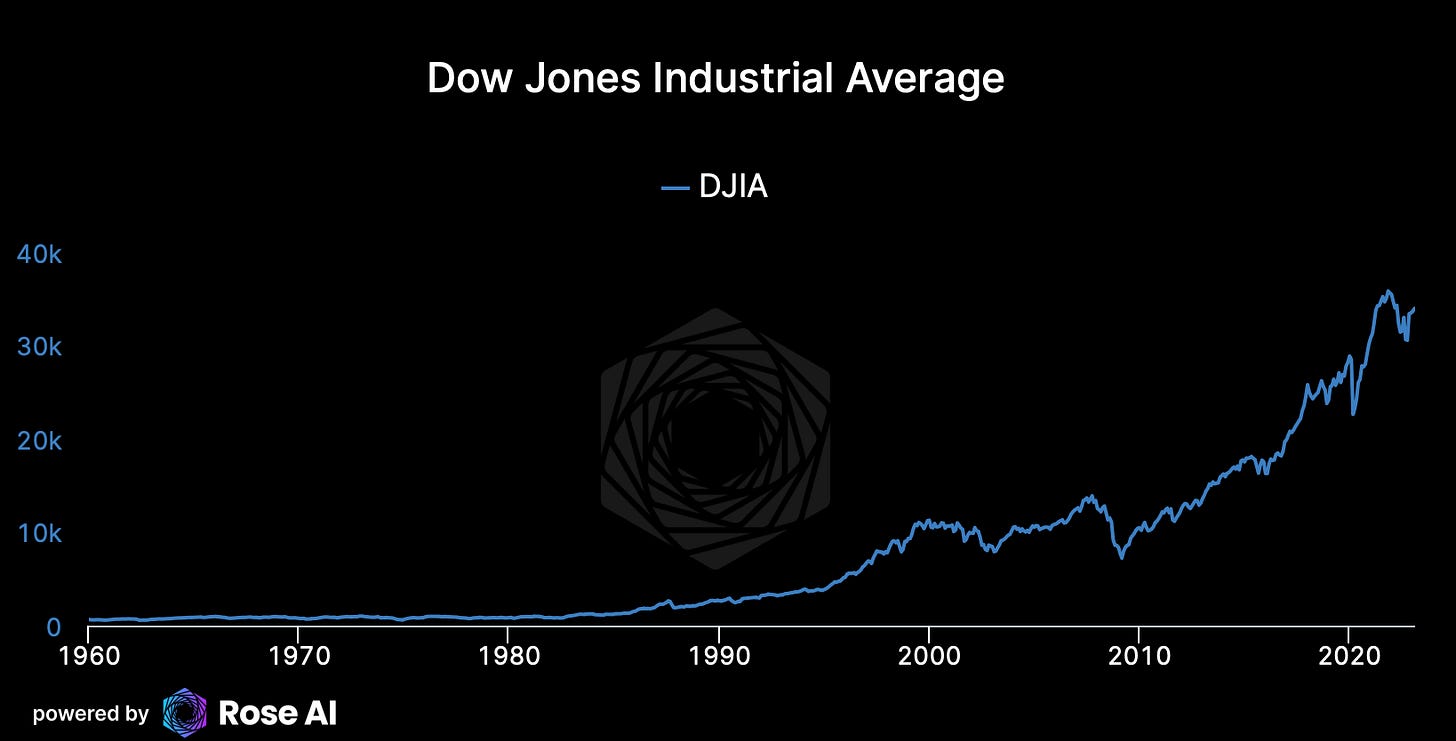

In reality, the 60% stocks, 40% bonds portfolio is virtually an all-stock portfolio because the stocks are so much more volatile than the bonds. In the US, winning two world wars, political stability, a reserve currency, rule of law, relatively quiescent inflation and a technology boom has been good for stocks, thus good for 60/40. Luck, really.

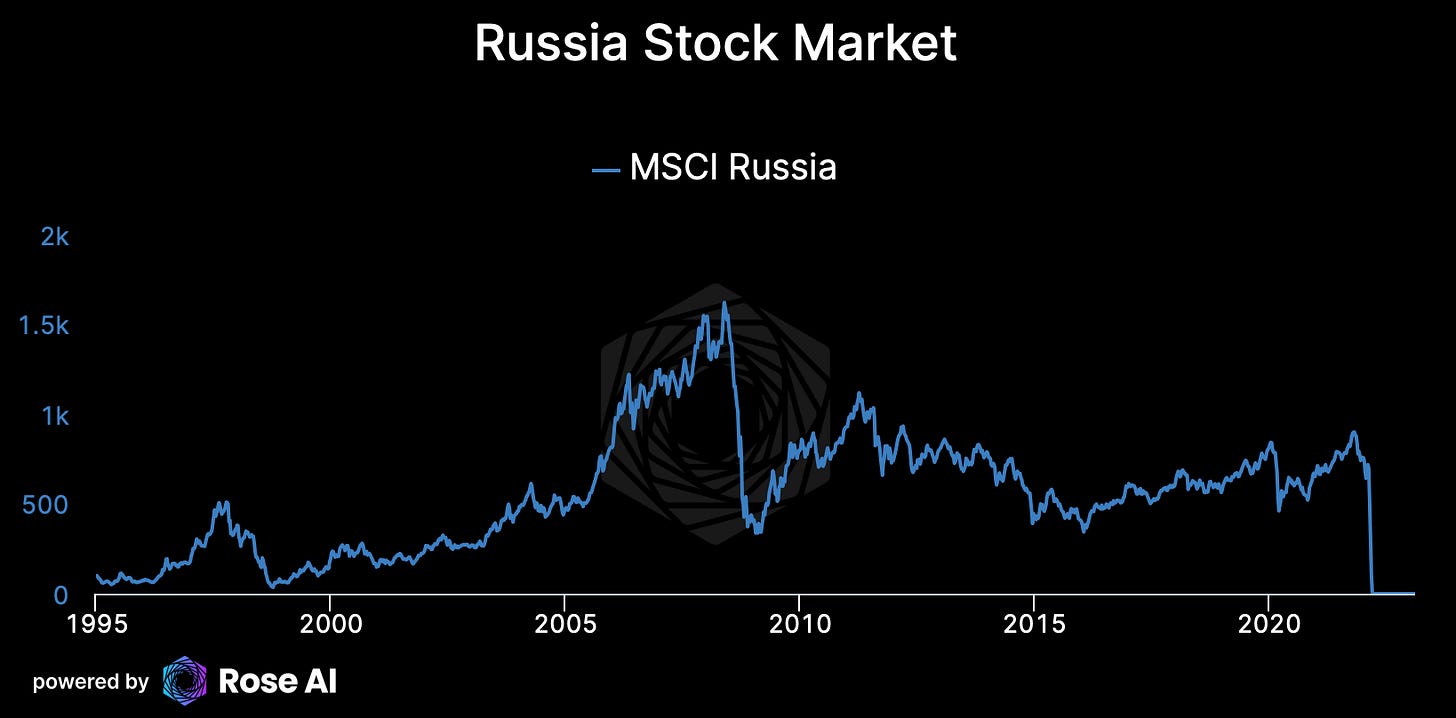

But that’s not true for most countries. Bouts of political instability destroy wealth, fast. Germany in the 1920s and 1930s is testimony to that and so is, more recently Russia. The return on investing in Russian stocks is…zero, even worse if you didn’t happen to buy on day one, as the chart shows below.

“If Chile privatized Codelco, production would soar,” said one source.

Chile has the biggest deposits of copper but the productivity of the mines has fallen over time and the metal purity is a fraction of those in the DRC (Congo). Extracting Chile’s copper requires more water, fuel and electricity than it once did. And Codelco itself seems like the Department of Motor Vehicles. My efforts to get their perspective on this died in a vortex of emails and meeting rescheduling. After visiting their headquarters, I sat down to have eggs and coffee at this lovely Santiago cafe.

There is a scenario where the world gets electric cars, cleaner energy and Chile booms. There is also a scenario where Boric and his cronies make a second effort to re-write the constitution, nationalize the major lithium producer and the ensuing economic downturn makes porous borders more porous and Chile becomes more criminal. Friday’s paper reported that the army was robbed of some weapons last night, not a good sign.

I’ll be here for a while longer and head up tomorrow to the Atacama desert to see where the minerals are first hand. As I learn more, I’ll share. I share my investment conclusions with Subscribers below.