Notes on the Market Action

A brief update

I talk to myself, as many of us do, for much of the day—admonishing myself (“Your fool!, Where did you leave your glasses?”), encouraging myself (“You can do it!”), complaining (“Why is that car in my lane?”), and, more rarely, congratulating myself (“It’s done!”).

Hallucinations, Oliver Sacks, 2012

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

I had meant to go quiet for my vacation, but figure if I was reading a guy’s newsletter about what was going on in the world and the stock market tanked, I’d want to know what the guy was thinking.

My take:

1. Self-reinforcing selling. The epicenter of this storm is popular trades. The NASDAQ is off about 16% from its recent highs, though with its overnight fall, Japanese stocks are now 27% off their high. Below is the NASDAQ.

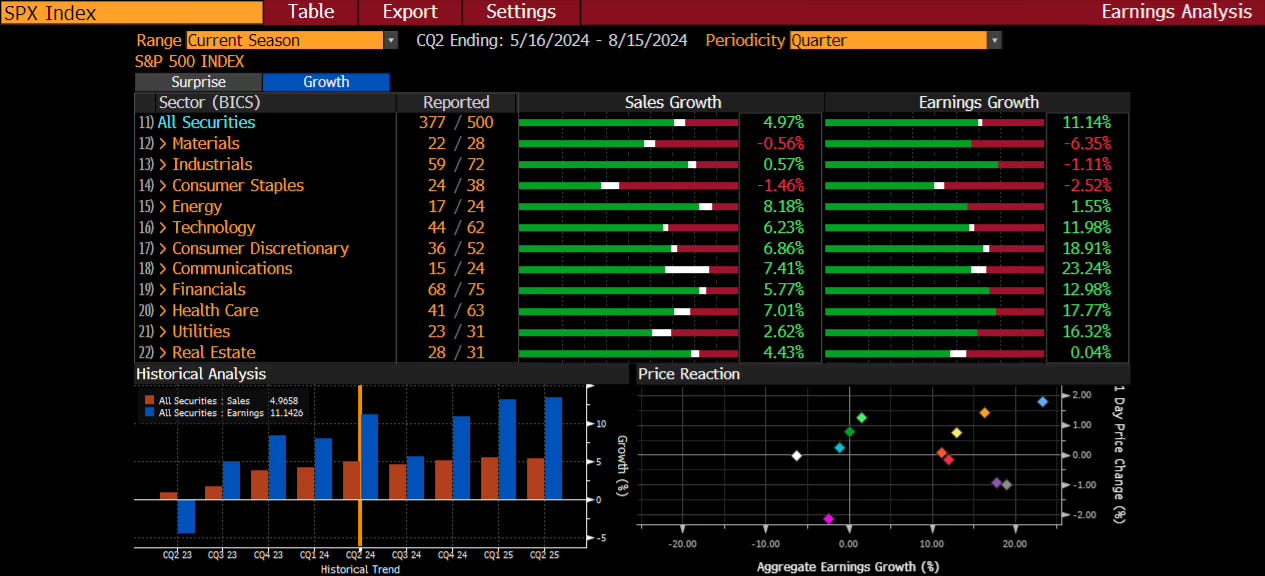

Price not earnings. The decline in stock prices and rally in bond prices (falling yields) is about the price investors will pay for companies with variable but positive cash flows relative to the price of certain but lower cash flows (bonds). It’s important to note the companies themselves are cash flow positive. Buffett reduced Apple because it was expensive, not because it was unprofitable. So far, reported earnings in the US grew about 11% in the most recent season, as you can see below. Sales growth was 5%, suggesting GDP growth of around 2%, which is healthy.

Slowing slowly. Supporting these earnings is income growth by households. Wage growth (one of many measures) is at about 3.5% from a year ago, slower but around average. Yes, unemployment is rising and wages are slowing, but that’s what was required to get inflation down. Numerous other data points suggest the same, the economy is slowing slowly, not imploding.

What is fair? The Price to Earnings ratio on the NASDAQ is now down to about average, 38 versus 37, though of course there is nothing stopping investors from demanding a yet lower PE, as they did early in Covid.

Yields, oil and buybacks. The market action is stocks down, bonds up, commodities down. Oil is off 5.5% in the last three months. Lower bond yields and lower energy prices are supportive for both price-to-earnings ratios and margins. Also, lower stock prices will lead cash flow rich companies to buy back shares, reducing supply, boosting price. I suspect value investors will start to nibble here.