“FDR 16 years — almost 16 years — he was four terms. I don’t know, are going to be considered three term? Or two-term?”

Donald Trump, May 2024

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

I predicted Harris would win.

Harris not only lost, she got crushed.

I see one good outcome and one concerning one.

The good one is the election wasn’t disputed. If Trump had lost, there might have been armed mobs in the streets. But given he won handily, he can’t claim the vote was rigged.

The concerning outcome is the unavoidable fact that Trump got where he did by bending and breaking norms and that this is sure to continue. I thought the majority of Americans would be concerned about that but they clearly are not. If anything, they are heartened by it. By now you’ve read countless articles about the election and are not here for more. The most basic human instsinct is self-preservation and my take away is voters have different templates for what insures survival.

For some, preservation means not attempting to subvert term limits, as Trump indicated he is considering in the quote above. For others (including some of my friends), “order” means stable prices, support for Israel and an end to political correctness. The German sociologist Max Weber distinguished rational-legal authority from charismatic authority. Trump is charismatic authority and in times of disorder (mostly brought on by rapid technological disruption) sometimes voters believe charismatic leadership is the path to self-preservation.

Now that Kate Capital is up and running, I can’t be as direct as I once was about exactly what I am up to. I will paint the picture without delving into specifics.

Our election strategy (it’s a team) was that while we couldn’t predict the outcome, we could build a portfolio that would do well under either scenario. Our solution was a combination of being short foreign bonds with limited upside and a lot of downside and long domestic stocks we thought would do well regardless of the candidate. This worked. Now that the election is out of the way, a number of things are clear.

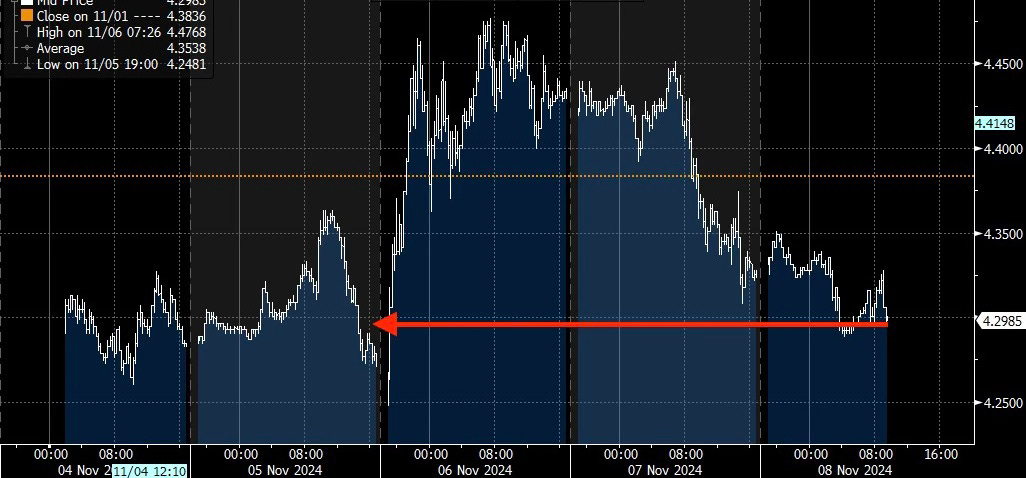

Trump will disrupt norms, parts of Washington will try to oppose him, other parts will enable him. What happens in practice for tax, tariff and foreign policy will be the midpoint of this battle. At present, the market seems to be betting that the policy disruptions will be modest and the establishment will largely contain Trump, as it did in his first term. Bond yields are almost unchanged since Wednesday. I suspect that is wrong.

Assuming the Republicans take the House, they will want to cut taxes. Trump can and almost certainly will implement tariffs even if Republicans don’t take the house (and they probably will take the House). The US budget deficit is currently 6%. Trump tossed out a lot of proposals during the campaign, from eliminating taxes on social security to eliminating income taxes altogether. The basic idea is paying for tax cuts with tariffs. Tariffs increase inflation (because the cost of what you buy goes up) and tax cuts increase spending (because you have more money) so the impact is more spending and inflation.

This potential fiscal push is coming as the Fed is cutting interest rates, which they did yesterday. I suspect this policy will be pursued (tax cuts and tariffs) up to the point that they create an unambiguous financial consequence, namely rising bond yields and a decline in equity prices. On a podcast last year, I asked Congressman Jim Himes if Congress paid attention to the bond market. His answer was “no.” I suspect that will change some time in 2025.

Tariffs also will create pain elsewhere in the world, yes of course in China but in Europe as well. Europe is a manufacturing and trade powerhouse but a combo of a weak China, US tariffs and domestic fiscal contraction (they are trying to reduce deficits) will likely sink Europe into a recession which the ECB will struggle to counteract. This means the ECB will need to ease a lot and also that this easing might not work.

Trump is a game changer in international affairs. Trump will do a deal with Putin and carve up Ukraine. If I were on Ukraine’s front line right now, I’d be thinking hard about what comes next. Moreover, Trump will likely also do a deal with Xi and carve up Taiwan. To be sure, there is a strain in the Republican Party that is adamant about opposing Putin and Xi. How hard will they resist Trump? Based on what I observe, my answer is “not much.” The question as always is—what’s in it for Trump? The answer is perhaps US companies get unfettered access to Russia’s commodities (like uranium, which is crucial for the AI revolution) and China’s domestic market. Maybe TSMC’s engineers are allowed to move to the US. It’s a trade of money for liberty. Regarding Europe, it will be every nation for themselves in terms of defense spending. Defense spending is unpopular in Europe, getting anything approved takes forever and most NATO members are spending well below US levels on defense measured as a percent of GDP. But if the US pulls out of NATO, Europe will have to step up defense spending.

In short, it looks like it will be an inflationary boom in the US, a grinding bust in Europe and Ukraine and Taiwan will get absorbed by Russia and China. An era of post-war US foreign policy is over. The people have spoken.