Optimism & Fear

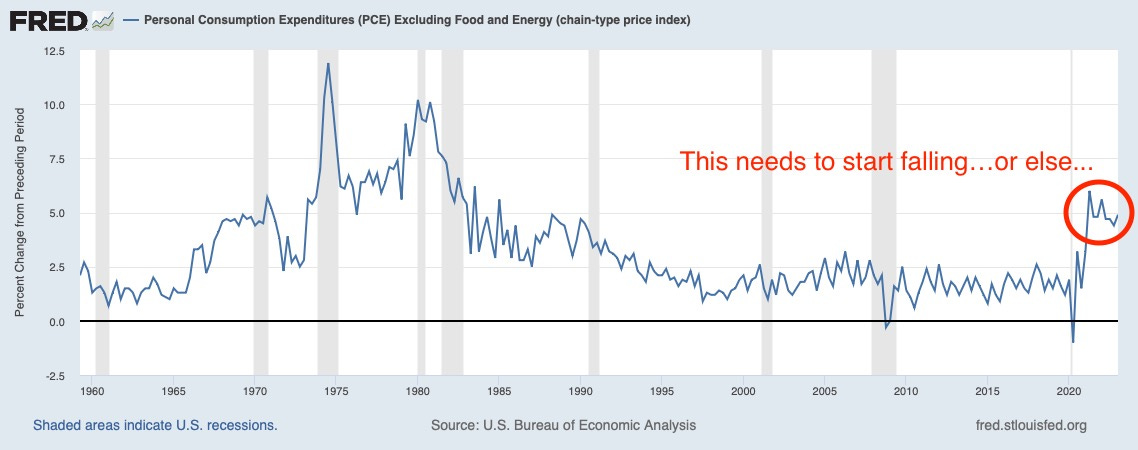

I woke up last night at around 1 am worried about an economic report (personal consumption expenditures, or PCE) that was published today at 830 am. Before PCE came out, on the early morning drive down to the rowing dock, I listened to gloom and doom Bloomberg radio chatter about “stubborn” inflation and more Fed tightening. Bill Dudley, the former head of the New York Fed, confidently declared this morning that “the US bond rout is far from over.”

I’ve been thinking the worst is over, that inflation will ebb, thus the changes in my portfolio from defense last year to offense this year. My 1 am voice asked: am I wrong? I’m either about to get crushed or this is an opportunity, the moment when the consensus is offside.

Wall Street can be divided into two camps--optimists and pessimists--which roughly correlates to equity and bond investors. I’m trained as a bond investor, ever mindful of inflation and the fragility of fiat money. Given the Fed’s preferred inflation measure—PCE—is falling only gradually, I am a little worried. But I think stock investors, some of whom I have recently befriended, are both wired for optimism and probably have it right this time, meaning we are indeed getting a soft landing, which means slower growth, less inflation, but no apocalyptic growth implosion.

Like any schism, there is truth on both sides. Some helpful context for readers for whom this debate might sound abstruse.

A bond is a loan. A loan to the government is called a Treasury. There are also loans to corporations or municipalities or individuals. Government bonds have two moving parts, a real yield and an estimate of future inflation. Both typically become more valuable when growth weakens and less valuable when inflation rises so bond investors scan for weak growth and higher inflation. Past events, like the Great Depression (growth collapse), 2008 (growth collapse), 1970s (inflation), and today’s inflation loom large.

An equity is an ownership share of a business. Equity rises in value when the economy and profits are growing, and when a company’s costs (inflation) are falling. If a new whizz-bang technology comes around, like the internet or artificial intelligence, then certain companies can make crazy money. In the last 5 years, Apple has earned $250 billion in profits. Since inception, the stock is up 86,000%. Equity investors live with the eternal hope of finding the next Apple.

Over time, the optimists have been more right than wrong and equity investors who have held stocks, particularly US stocks, and had (over) confidence in the future have done much better than gloom and doomers hoarding gold and avoiding risk. Growth is fueled by productivity which, in plain English, means healthy, educated people with access to new technology doing new creative things to improve our collective lot. We used to plow the field with a horse, now combine tractors, freeing the rest of us up to write Substack (that’s a joke). Food, magically, shows up in the grocery store and we feed 8 billion today more easily than 2 billion when my Grandfather was born. If you look at the facts, rather than the headlines, things are broadly going surprisingly well.

For instance:

Global life expectancy is 71 versus 57 when I was born.

When I was a kid, 67% of the global population was literate; today, 87%.

We are living amid exciting technology shifts; the watch I wear does things the first James Bond, in 1962, could not have dreamed of.

We are, on average, much wealthier. Global GDP/capita has risen to $12,000 from $700 when I was born. Real household net worth in the US is around 8 times higher than when I was a kid.

While global warming is scary, where I live, on Long Island Sound, the water is much cleaner than it was.

More short-term, CPI (one measure of inflation) has fallen from 9% to 4%, with only a small rise in unemployment, and PCE (another inflation measure and the report I was worried about) fell to 3.8%.

Due to strong growth and falling inflation, since the onset of the pandemic, the US stock market is up 90%, German stocks are up 36%, and Japanese stocks are up about 50%. In the US, you can now earn 5% by holding short-term cash.

The US didn’t default and Putin isn’t winning.

All of the above bodes well for the future. But the pessimists aren’t stupid. The pessimists note that “core PCE” isn’t going down very fast. That’s true.

But the PCE numbers don’t tell the whole story. No economic measures are perfect. Measures like headline inflation or super core inflation, which strips out real estate, point to weakening inflation. Commodity prices (which we get in real-time) are also weak. Oil prices are down 6% in the last few months and copper prices are down almost 9%. Unemployment has been slowly rising since January (to 3.7% from 3.4%), which should begin to hit wages and drive inflation yet lower.

The perfect portfolio combines the fears of the bond investor with the optimism and value tilt of the equity investor. I don’t know anyone who has pulled that off, but I want to try to build it. More on that later. Below is how I am positioned today.

Also, before getting to the asset allocation, two housekeeping issues. One, I will write through late July but then take a few weeks off while I travel. Two, I am going to boost the paid subscription cost to new subscribers, likely after I return from my travels. After consulting with a number of people, the value of the “calls” or transparency into my activities is substantially higher than the cost of a subscription. And, of course, this isn’t investment advice.