“No matter what the circumstances, uncertainty is all we truly have.”

-Pema Chodron

Today I speak before the board of a large public pension fund that asked my perspective on what is going on in the world. Below are my thoughts.

We have staggered through an extraordinary disruption, a global pandemic that killed 7 million. If you are reading this, you survived. Three plus years later, things are still getting back to normal. Example: subways. Across the world, ridership plummeted during the pandemic and never fully recovered. The chart below shows what happened in San Francisco, where the San Francisco Municipal Railway is struggling to gain back even half the riders it lost.

The point—we’ve lived through something quite unusual. Before I get to what will happen next, it’s valuable to step back and see both what geopolitical and economic conditions were before the pandemic, which then provides context for where we are now.

Where We Were

It’s easy to blame policy decisions in 2020 for the high inflation and volatile financial markets of 2022 and 2023. But before doing so, it is useful to remind ourselves what conditions decision makers faced at the time. In those first scary weeks in early 2020, no one knew what was going on. I recall putting on gloves and a mask and heading to the supermarket, the trepidation on everyone’s face. Stocks quickly lost a third of their value.

One expert told me the fastest a vaccine would be available was in five years. The Federal response was disjointed but included massive fiscal stimulus. The chart below is from the IMF and the axis is spending as a percent of 2020 GDP. These are truly gigantic sums of money.

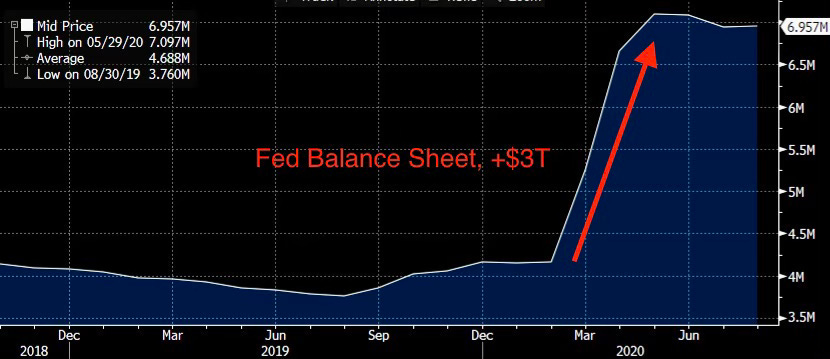

In addition to the fiscal stimulus, the Federal Reserve and most central banks printed. Remember that real interest rates were negative when the pandemic struck, so their behavior seemed reasonable enough given the fear and conditions. Below is the Fed’s balance sheet.

In response, stocks shot higher, fueled by both Fed printing and surging, fiscally driven consumer demand. A supply/demand imbalance for goods and people created what appeared to some as runaway inflation, which in turn triggered the massive tightening and the subsequent decline of asset prices (absent tech stocks) last year and this.