If someone forwarded this to you, my name is Paul. You can read about who I am here. This Substack grows via word-of-mouth, so please forward to your friends. If you like this writing, you will enjoy my books Master, Minion and Raising a Thief. Subscriptions are a vote of confidence and book and podcast reviews help lead others to my work.

Today’s post is a podcast with shipping expert J Mintzmyer. You can hear the full episode here. Why a podcast on shipping? Because shipping is the backbone of global trade.

Most of the “made in” somewhere objects you buy come via ship. You’ve seen these boats out on the ocean, floating, enormous metal ships hauling cargo from one part of the world (often China or the Middle East) to the next (like the US and Europe). But how does that miraculous network of boats and supply chains actually work? Well, the beauty of money is that you can put a price on every piece of this activity and see how the process unfolds.

This was particularly useful during the pandemic when port traffic seized up, but it is also what I love about individual stocks in general. You want understand how a specific sector works? Understand individual companies. How many container ships exist in the world? At what rate are boats getting contracted? Carrying what type of cargo? As much as a novel tells the story of psychology and intrigue, a properly understood stock explains objectively how the economy works.

J is an active-duty Air Force soldier, a former White House intern, and an expert on all things shipping. I’ve been tracking his calls and subscribing to his service (not cheap) for about two years, more on this in the investor section further down. I was interested enough in his story that I asked him to join the podcast.

A few points stood out to me.

The meritocracy is alive and well. J grew up the son of two working-class parents, living part of the time in a trailer in Arizona. His father is a plumbing contractor who never owned a stock. J went from that to the Air Force Academy and is now getting a Ph.D. at Harvard as well as running his investor service, Value Investor’s Edge. It’s a story of hard work and perseverance.

Creative destruction, including around financial services, is also alive and well. When I became a banker in 1998, research was offered as a wrapping to distinguish the commoditized business of transactions and settlements. While there was independent research at the time, it was a tough gig. That’s now changed. J and his team use the Seeking Alpha website to host their subscription service. He has been building this up for years and now has 500+ Subscribers paying about $3,500 a year.

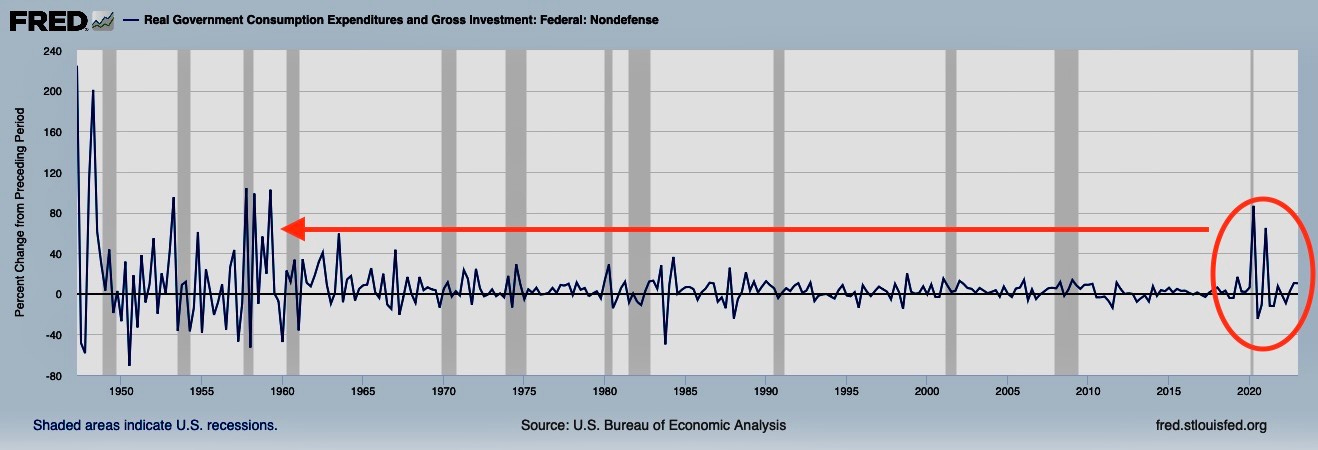

There were two parts to the surge in US inflation. The first was, in response to the pandemic, the most aggressive fiscal stimulus since the Korean War, shown below.

The second part was, as J said, ports operating at almost 100% capacity. “This was a festering issue” before the pandemic, he said. When the government hit the fiscal gas, millions of people set up home offices or made other purchases. Wham, the ports had a heart attack, manifesting in higher inflation. You can see the explosion of demand below. The combo of surging demand and port constraints “breaks everything,” said J.