THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Because stocks have bounced, a sense of normalcy is returning. But beneath the surface, risks abound. Today, I want to focus less on the storm and more on the false sense of normalcy—and what’s creating it.

We are witnessing an effort at regime change. It’s as if the White House dropped a policy boulder into a lake, and the ripples bounced off the edges and are now reverberating back to the center. The lake is our financial system and international relations. Here are those ripples:

Regime change is a loosely connected set of often contradictory policies meant to favor “Main Street over Wall Street,” in their language. The primary villains are China and liberal elites; the heroes are a mythical working man—even though this mythical hero buys tariffed Chinese goods, owns a mobile phone (91% of Americans), and saves in stocks (62%). The White House believes reviving manufacturing will revive the U.S.—think shipyards instead of Silicon Valley. In investor terms, regime change upends the cash flows of every asset you might own. For example, Yale and Harvard—supposedly long-term capital and deemed by the White House as too DEI—are dumping their private equity holdings, forcing down the prices of assets many considered safe. It was these wealthy endowments that enabled such schools to be need-blind. In truth, a well-functioning Wall Street directly benefits Main Street. Just ask the North Koreans, even if the wealth gap Wall Street creates does bother many people.

Now stocks are up—why? Partly because the White House is walking back tariffs, and markets expect more retreats. I heard someone describe the tariffs as “Swiss cheese.” “Liberation Day” increasingly looks like a rough draft of a concept. Market structure also matters. When stocks collapsed (22% from top to bottom), some investors sold near the lows. Then came a tariff “pause.” Stocks rallied, but those investors stayed short. Then came exemptions—electrical goods, car parts, etc.—and stocks crept higher, forcing shorts to cover. The result? A slinky-going-uphill recovery. Stocks are now as expensive as they were before the tariffs were announced—which makes sense if tariffs are eliminated. They won’t be, though some will be reduced. I suspect the weighted average tariff will be around 15% to 20%: 10% on most countries and 50% on China, with lots of exemptions. That’s why I suspect this rally is an intermission. Shorts will probably fully cover just as growth begins to slow—perhaps a month from now.

The same position adjustments are playing out across other markets. Stocks are above their pre-Liberation Day levels, and now bond yields and the dollar look like they’re headed the same way. The same dynamic applies: leveraged players caught wrong-sided, forced to cover, causing a slinky-like cascade—until prices are wrong again.

Tariffs in the U.S. slow growth and boost inflation. Abroad, they slow growth and stir resentment toward the U.S., but without much inflation. The cost is paid by U.S. consumers. The White House cleverly describes its policy as “reviving domestic production” instead of what it is—a tax. This weaker foreign growth is now driving central bank policy. The absence of global inflation is why the Bank of Japan said this week it would stop raising rates. It’s also why the Federal Reserve will be slow to cut—something they are almost certain to remind investors of this coming week.

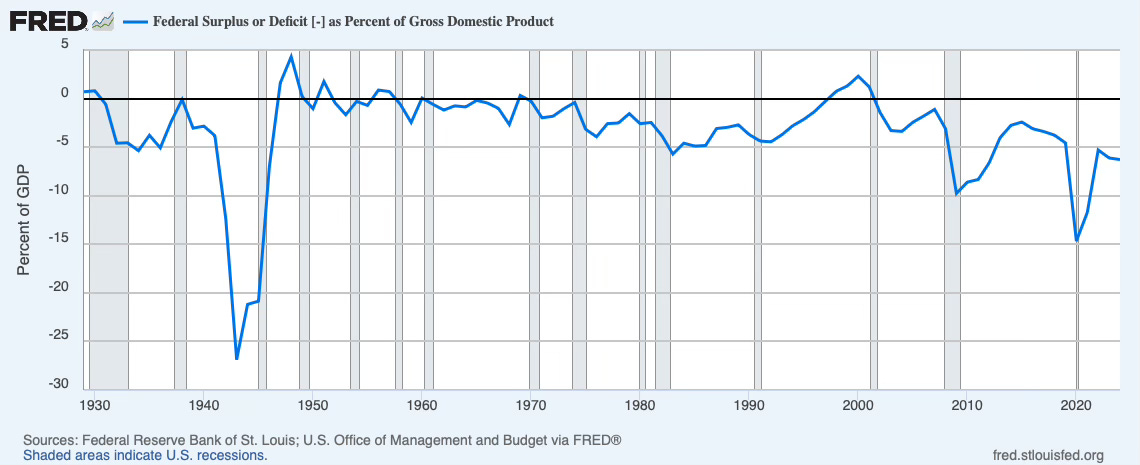

The locus of financial disruption may shift from stocks to bonds. Tariffs hurt consumption and profit margins, so it made sense that stocks were hit first. But the White House and Congress are now working on a budget that looks to be as reckless as the tariff policy—a large increase in the deficit when the deficit is already large. It has only been larger during war, COVID, and the 2008 crisis.

Foreign policy ripple effects are emerging in Canada and Europe. Mark Carney’s victory in Canada is one sign. In Europe, it’s rearmament. Ukraine gave up its nukes in 1994 in exchange for guarantees from Russia, China, the U.S., and Europe to honor existing borders—including protection of Crimea. This was the Budapest Memorandum on Security Assurances. Instead, Ukraine was attacked, lost tens of thousands of its citizens, and received incomplete support from the West due to fear of nuclear war with Russia. The lesson? Get nukes—and if you have them, never give them up. More broadly, the U.S. security umbrella is diminished, forcing others to defend themselves. The deal just signed in Ukraine is deceptive. There are no economically viable rare earths in the territory Ukraine controls. It’s a distraction for a domestic U.S. audience—something the Kremlin understands well.

Policy ripples in Asia. China has signaled it wants to take over Taiwan before Xi leaves office. That risk is rising. From Beijing’s perspective, the U.S. is weak and erratic—and Taiwan is far from Washington. I’m told Trump’s behavior has boosted Xi’s popularity at home. There are winners—like India. They’ve long wanted cutting-edge U.S. fighter jets, and now they’ve figured out an easy way to get them. Of course, this will push long-time foes Pakistan and China to make sure their nukes are ready.

The White House has a vision—Main Street—but the path is haphazard. That won’t change. But the White House operates within a national and international system that is exerting pressure to adjust and moderate course. Assets will find equilibrium when these forces balance, when the waves calm. Last week, the WH nearly triggered a global financial collapse by threatening to strip the Fed of its independence. This week brings more walkbacks and a rally—but no deals, despite earlier promises.

If you come out the other side with your assets mostly intact—or even a little more valuable—you’ve done just fine.

NOTE TO READERS — I WILL BE TRAVELING FOR THE NEXT FEW WEEKS AND WILL POST WHEN I CAN.

Have a great trip!