Democracy is predicated on the belief that the majority makes better decisions than a ruling elite.

Barton Biggs, 2008

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Today I want to talk about the Kamala Correction and ask you about next steps for this Substack. The roughly 8% correction is less about the economy going bad and more about winners and losers and the risk of conflict.

My basic points:

a) The US economy is slowing slowly, Europe is slowing more and China is entering a deflationary depression. There is no imminent economic crisis though the momentum is clear.

b) The policy differences between Trump and Harris are meaningful and getting priced into the market but it isn’t clear who will win, thus the volatility.

c) The geopolitical risks are real and billions of dollars are getting redirected for that purpose.

Shifting Winners

The stock market sometimes catches major inflection points well before the experts. An example is World War 2. The German, British, and American stock markets identified the turning points in each country’s fate even as “wise” commentators missed it, as Barton Biggs noted in Wealth, War & Wisdom. I’ve seen the same thing with markets in my lifetime. For instance, housing stocks began to tank well ahead of the 2008 housing-led credit crisis. As a result, I’m looking at this week’s correction in the US stock market and wondering if it’s more than a typical reversal in a bull market. Here is the potential logic:

Until Biden announced he was stepping down Sunday, it looked like Trump was going to win. Now the odds are shifting fast. Trump’s line (red) is moving down while Harris line (blue) is moving up.

At this point, we don’t have complete policy information but we do have rubrics. Trump equals less regulation, big government spending and coddling dictators, which is bullish tech, energy, and bitcoin and bearish defense. Not as much is known about Harris. Assume she is a classic California liberal. She will be for higher taxes on the rich, environmental regulation, civil rights, and rule of law. That platform is anti-drilling and gas exports, possibly bearish tech (because of the monopoly break-up risk), more fiscal prudence (thus bullish short rates), and bullish defense because she has offered full-throated support of Ukraine. The market action syncs up. Note that Raytheon, a defense contractor, surged.

It’s interesting to me that Navigator Holdings got crushed. Navigator profits from the massive difference in the price of natural gas in the US and Europe, low here, high there. Biden has put curbs on natural gas exports. The market seems to fear a President Harris will extend, or make even more severe, those cuts.

This is happening against the backdrop of a much riskier international environment. Tens of thousands have died in Ukraine, Israel and Gaza. Just as the US and Europe faced a diabolical combination of Nazism, Stalinism, and a militaristic Japan in the 1930s and 1940s, the free world now faces a triumvirate of Putinism, Jihadism, and a Maoist Xi revival. A reader sent me the following story from The Economist that noted China’s vast stock-piling of commodities, meaning they are accumulating supply. This is a worrying signal, the type of thing that would be logical to do ahead of a Taiwan invasion.

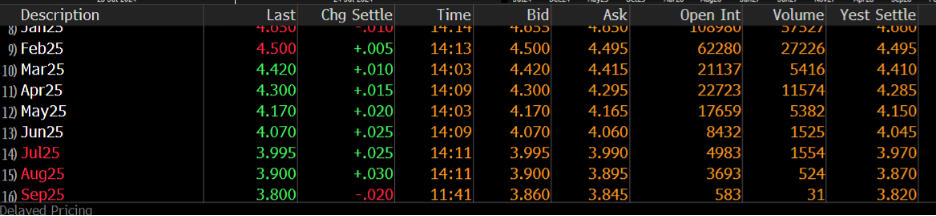

It is unusual to get a stock sell-off when most central banks are either already easing (Europe, Canada, China) or about to ease (the Fed). However, it’s also true that a lot of easing is priced in. People miss this. At this point, the Fed needs to cut more than 200 basis points to give the stock market a push higher via easier policy. Inflation is still a little above target so such an aggressive ease seems unlikely. Below, I show what is priced in the bond market for Fed cuts. The current policy rate is 5.3% and it is now priced to fall to 3.8% by next fall. That said, tighter fiscal policy may require easier monetary policy.

If this is a typical correction, buyers will emerge soon. And if Harris is smart, she will keep her policy vows very narrow: support for abortion, support for Ukraine, support for a strong economy. But I am watching for the possibility that something bigger is afoot. Below I show the Nasdaq. So far, nothing out of the ordinary.

Next Direction for this Substack

This newsletter has grown from 200 subscribers to many thousands and, if Substack’s statistics are correct, is read in every US state and most countries. However, what I’ve noticed is:

A. Only a small percentage of free subscribers go paid, perhaps because of the cost, and

B. The paid subscribers get a front-row seat into my asset allocation decisions but most of them can’t do much with that information because they are never going to short a market or buy options on futures and

C. I’ve predicted many things in these essays and plenty of them (not all of course) have been correct. Recent examples of accurate calls:

On 4 July, I wrote: “let’s see if the US maintains a degree of flexibility and swaps in a new democratic candidate.” That just happened.

On May 31, I explained, here, why the yen would rise. That just happened.

And in January I shared this:

That’s not exactly what happened, but it is close.

So while I’m sharing my (foggy) crystal ball, only a minority seems interested. Later this year, I and some key collaborators are opening an investment management firm, Kate Capital. Investors there will see what I am doing but subscribers no longer will. So what should I do with this Substack? I could stop writing these essays and focus on my books and Kate. I could make the essays free and skip the asset allocation. I could reduce the price and talk about what I am doing in general terms but not get into the specifics. I am not sure. I will host an Ask Me Anything this Sunday at 930 AM New York time and hear your thoughts, if you have them, or you can write me.

Here is the zoom.

https://us02web.zoom.us/j/83673674821?pwd=dover8aOtfbYI2uPL660R7gSRDcXW0.1

I normally only do this for paid subscribers but if you are out there reading this, I’m curious to meet you and hear your thoughts and what you’d advise me to do given my evolving circumstances. If you want to connect a face to a name, this is me cooking dinner for my wife this week.

Portfolio Shifts