Trump 2.0

Everything that was considered good and beautiful in the age of the pyramids was held to be just as excellent a thousand years later.

Gombrich, The Story of Art, 1950

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

This month was about one thing—Trump. What most catches my eye is what didn’t go according to expectations. Yes, stocks are higher but bond yields fell. Investors believe Trump/Musk + R control of Congress and the Supreme Court = massive decrease in government spending. I am skeptical.

This post is about what happened, what Elon is saying and where the next surprise can be.

The Price Action

There have been three phases this month. First, was Trump beating Harris and the R sweep. Markets initially acted as expected, stocks soared, bonds sold off (yields higher). Trump is about tax cuts and tariffs, which are inflationary, de-regulation is pro-growth and animal spirits.

Bond traders then “took profits,” which is to say closed positions, buying bonds and driving yields lower. On November 13, Trump selected Matt Gaetz to run Justice. Investors decided Trump was going to hire extremists into positions of economic policy as well and drove yields higher, all the way to 4.5%. The same price oscillations are evident in the stock market, which promptly fell when Gaetz and other loyalists were nominated. Then, a week ago, Trump nominated Bessent for Treasury, stocks jumped and bond yields fell and have continued to fall.

Initially, I could not understand why the market reacted so strongly to Bessent’s selection. He isn’t that well-regarded on Wall Street. His performance has been more mediocre, with occasional bursts of fantastic returns. Bessent’s signature message is "3-3-3;” 3 million more barrels of oil pumped (deflationary, likely won’t work), 3% growth (we are already growing about 2.5%, maybe more) and 3% budget deficits. The 3% budget deficit is what markets have latched onto.

From what I can see, Trump has not said much about the 6% US budget deficit. But after a few days of tossing and turning at night, something clicked in my mind. Bond investors are not watching Trump, they are watching Elon. And Elon, Joe Rogan, Marc Andreessen, and that tribe is sending an unmistakable message—they believe they have a unique, once-in-a-lifetime opportunity to do to the Federal Government what Musk did to Twitter—fire most of the staff and strip it to a bare-bones operation, theoretically saving a lot of money.

The federal government isn’t a private business. Just like McNamara was a brilliant businessman and a horrific Defense Secretary, private sector experience often doesn’t translate well into the public sector. The most radical budget solutions—like radically curtailing Medicare or Social Security—are non-starters because they are wildly unpopular.

The Gameplan

Elon isn’t inside the government, he is an advisor with no policy-making authority. Money flows through Congress, which has constitutional authority over the budget. The US spends $6.7 T a year and roughly half of that is on things that can’t be cut, as shown below.

Source: US Treasury

At first glance, Elon’s suggestions seem significant. The story I noticed was The New York Post, not The New York Times. This is cutting things like student debt forgiveness, weight-loss drugs on Medicare.

Then I went to Elon’s tweets. He wants to cut $2 trillion, not $1.4 trillion. He is trying to rally support for action. Note that the Tweet has 38 million views. According to the Treasury, we actually spend less on the national debt than on defense but it doesn’t matter, we are spending a lot on interest and this resonates with people as crazy.

However, it’s more complicated than a Tweet. Student debt payments are an expected receipt, not an expense, so they won’t “cut spending.” And $1.4 t over 10 years is a mere $140 b a year, nothing compared to $6.7t of spending. The market seems to believe that Trump 2.0 means something fundamental to the structure of government. But I smell euphoria and think the big move is, ultimately, bonds down, stocks down.

What Will Actually Happen?

Trump is more wedded to tariffs and tax cuts than cutting spending and Congress is an ossified institution that will fight what Elon is proposing. The more savings Elon comes up with, the more Trump will cut taxes, so we likely end up with no change to the deficit until we get a debt crisis, like what has happened in the UK, France and Brazil.

Moreover, there are two other vectors — the Fed and defense, both of which point in the other direction.

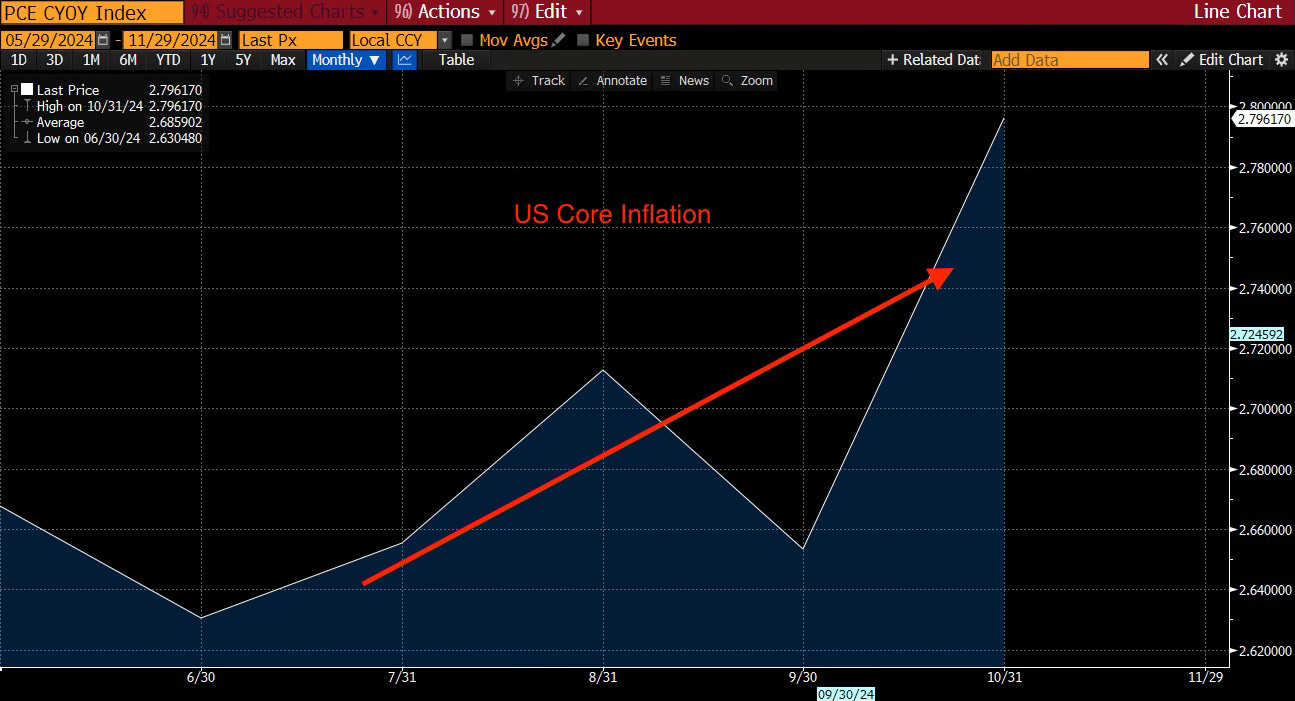

The Fed is cutting interest rates even though inflation has now stopped falling and is even rising some. The right thing to do would be to not cut. If that happens, it will whack the bond market, hard. We get payroll and CPI data before the next Fed meeting. If either of these is stronger-than-expected, the Fed will not cut, which is bond bearish. If the Fed announces its cuts are done, bonds can sell off sharply.

Second, while Trump would like to pull back from US defense commitments, if he does he will look weak, Russia will hold the parts of Ukraine it has seized and China may take Taiwan. Israel has shown the way. If attacked by neighbors bent on your destruction, respond with maximum force. If this is the model for US strength, Trump likely needs to increase defense spending, probably enough to further blow out the Federal Deficit, send advisers to Ukraine, beef up defenses in Taiwan, etc. Think about where we are in the world—two hot wars, North Korean troops in Ukraine, NATO weapons fired into Russia and Xi resolute to take Taiwan. It looks a little like the 1930s, with Putin in the role of Hitler and the US so far (under multiple administrations) in the role of Chamberlain, though Trump could just retreat.

I suspect the medium-term path is 4% Fed Funds and a 5% to 5.5% 10-year rate and a stock market decline but we are not heading there today. The market is in thrall with what is going on and believes that it is possible to have a deflationary boom. The US has hired magicians and awaits their magic.

Makes sense to me the DOGE deflationary is a hard fade. Most cost cuts require passing legislation. The Rs have a tiny advantage in the house... they lose 4 votes and they can't do wildly unpopular dumb things. Another dimension of this is that Federal employment costs are tiny at 1% of GDP... and most of those people work at the department of defense, homeland security etc. Why is this group of conventional republicans any different than the ones that failed to cut in the past? If there is one thing we learned from Trump 1.0 is that every person that worked for the man regretted it. Having a side commission on cost cutting is mostly just going to give Trump someone to blame when the deficit isn't cut and the bond market eventually pukes.

On the oil increases I wonder if it will end up mostly being NG and NGLs. At the current curve there is little reason for private sector drilling for oil. Natural gas and NGL exports though... plenty of room to expand that. Permitting and allowing NG to be exported will be a good thing for producers closing some of the global price gap. I think/hope this is one part of the program that actually works. I like NG here.

3% growth is very achievable if they keep doubling crypto prices every year or two. If the imperial palace of Japan could be worth more than all of California at one point, why can't MicroStrategy (MSTR) also do the same? Recent growth rates have a lot of wealth effects baked in. Does that keep going for years? I doubt it.