In an ideal world, the scientist should find a method to prevent the most severe forms of autism but allow the milder forms to survive. After all, the really social people did not invent the first stone spear. It was probably invented by an Aspie who chipped away at rocks while the other people socialized around the campfire. Without autism traits, we might still be living in caves.

Temple Grandin, Thinking In Pictures, 1995

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Key points:

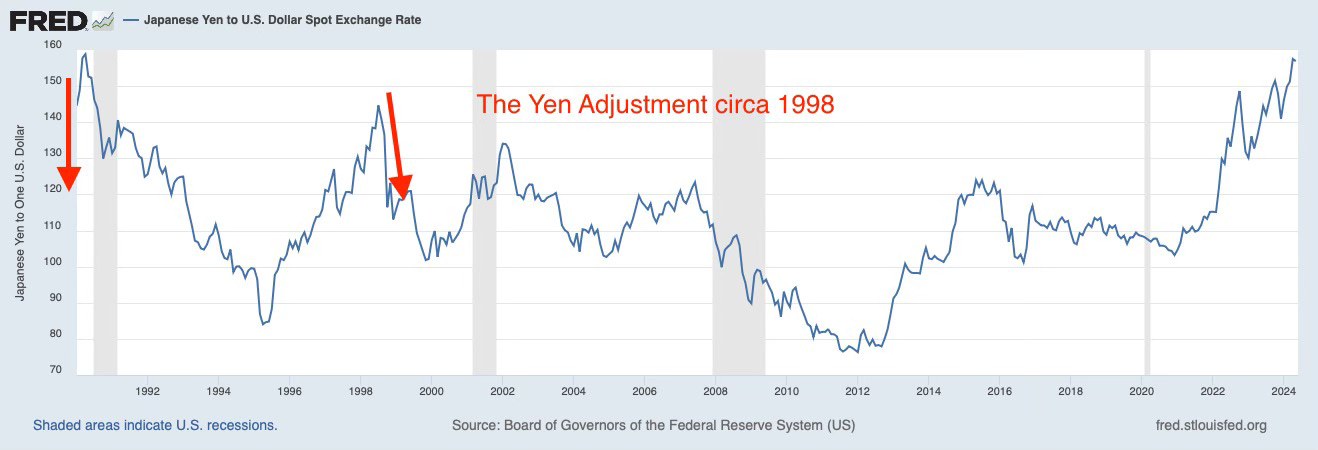

1. The yen is at the weakest level (in real terms) ever. This price sets in motion a series of transactions to reverse this pricing.

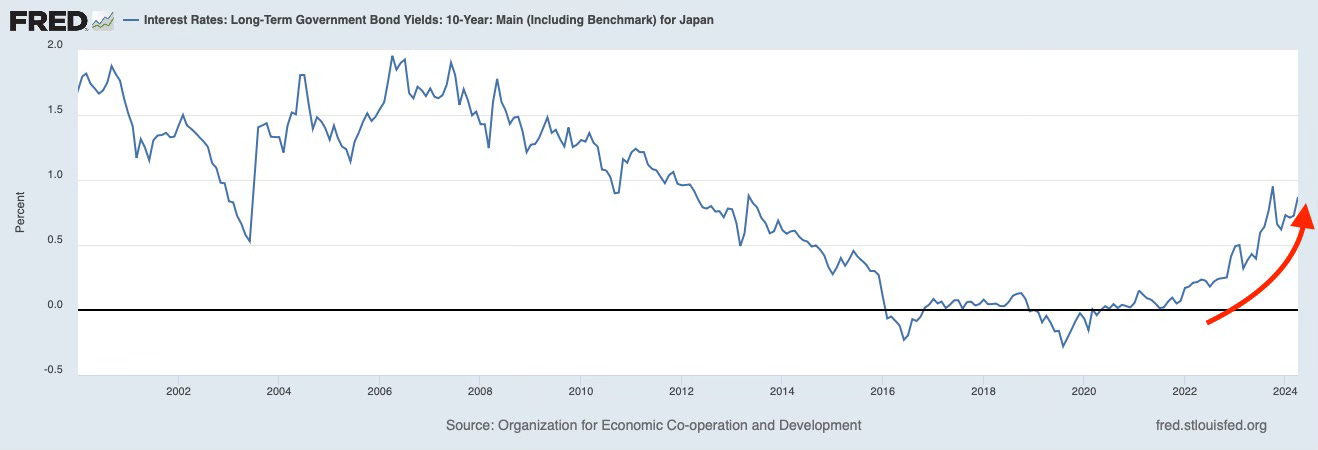

2. The Bank of Japan has begun, cautiously, to tighten monetary policy while the Fed is expected (discounted) to ease and data, including today’s inflation data, show the need to do so.

3. A currency is a price, and, like any other price, is formed by supply and demand. The supply of yen may begin to shrink and demand to rise.

More below:

Today, I want to briefly touch on the purpose of money and then turn to the yen.

Using Money Well

Last night, I attended the premiere of Ezra, a film written by Tony Spiridakis and starring Robert De Niro and Bobby Cannavale about raising an autistic child. The event was held a few blocks from Trump Tower and a Wall Street-studded Trump fundraiser. Both occurred hours after the conviction.

Having raised a neuro-non-typical boy, the film moved me to tears. Ezra was partially financed by Closer Media, founded by Chinese entrepreneur Xin Zhang. Xin used her money for a higher purpose--to finance a film that changed the way I and perhaps others will understand a father’s obligation to his child.

These posts are more about how money works than how to use it well. To me, money is not the goal. Money is a tool and just like it is hard to earn it, it is also hard to spend it thoughtfully. Money is what allowed Xin to do what she did. It certainly helped me raise my kids, who were both a handful and required an army of tutors, psychologists, special schools, marriage therapy and other interventions, as I described in Raising a Thief.

Some who read these posts loathe Biden. I recognize Trump, much as I dislike him, engineered some bold and prescient policy shifts (China). Still, I went home thinking that Xin’s use of money is the model I want to emulate, not that of the Wall Street titans pledging money for Trump. To the extent I am able to grow my wealth, I want to use it to shift the dialogue along the lines of Ezra, not inflame it.

The Yen

My introduction to financial markets was a violent one.

It was the fall of 1998. I was covering G7/IMF meetings as a reporter and soon to transition to a currency trading desk at a bank. At that time, pre-iPhone, real-time information was slower. I stood by a door as Larry Summers, then deputy Treasury Secretary, entered the building, speaking on the phone with a person soon to be my colleague.

“Are you sitting down?,” the colleague said.

“No, why?”

“The dollar has fallen from 150 to 120. There is no bid,” he said.

“What!??”

If you look at past wiggles in price for any market, they seem bereft of emotion. But if you are holding one of these assets at such a time, you will forever remember. My father, for instance, was a child during the Great Depression. Stocks fell 90%. I don’t think he ever recovered. Later, he kept most of his government paycheck in cash.

Flash forward a quarter century and the yen is back at those same levels it was in 1998. However, after printing an enormous amount of money, the Bank of Japan is beginning to tighten monetary policy at the same time that the Fed is expected to ease. The BOJ does this by buying less bonds, thus the yield rise.

Currency

A currency is a price formed by supply and demand. Let’s look at the pieces of that price formation.