This was an era where many huge companies had emerged and the public had begun to view such concerns as enemies, fostering the increasing use of antitrust legislation to combat the price-fixing combinations they had formed.

Engines that Move, Nairn, referring to the late 19th century.

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

I launched Kate Capital on 1 November. Since then, the traditional 60/40 (stock/bond) portfolio has lost about 1%. Stocks are up a little and bonds are down more. This asset performance is due to uncertainty around Trump’s policies. If he follows through on his campaign pledges (a big if) of tax cuts and aggressive tariffs, bonds can make another leg down and this time probably take stocks with them. If he backs off, we could see a meaningful reversal.

In an environment of known unknowns, I focus on what is knowable and adjust my thesis as new information emerges. For me, this is not a buy-and-hold environment, agility is required. Below is what is knowable.

1. Real interest rates are high; in fact, they are the highest in about 20 years. I suspect they are now high enough to constrain demand for those who need to borrow. From here, the economy slows.

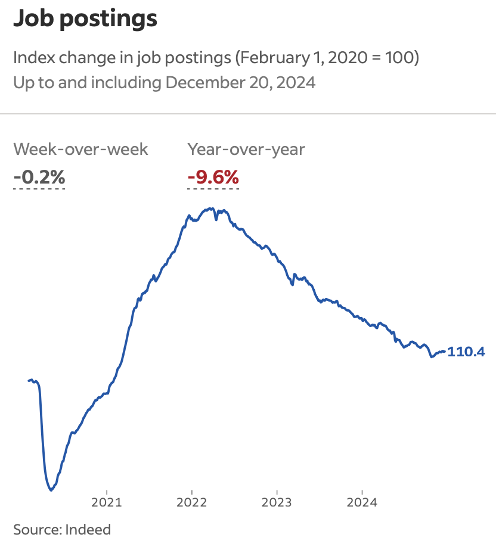

High borrowing costs will weaken demand for labor. While the bond market went haywire over the most recent strong employment report, I suspect the report is a fluke. The report is based on a survey. If you look at actual postings, like from Indeed, they show weakening. Other reports triangulate this.

As labor markets ebb, prices will fall. Market-based measures of inflation, as opposed to imputed ones, are also low. Below is the PCE (the Fed’s preferred inflation measure) based on actual market prices. It is at 2.4%. How high can inflation stay with the highest real interest rates in decades? This is the data Fed officials like Waller are talking about.

AI-related tech companies are in a boom, a boom that is in its early stages. I suspect the efficiency gains from those companies employing AI bots are the story for the next 24 months. Maybe robots and self-driving cars come after that. There are more and more anecdotal stories of psychiatrists, researchers, police departments, travel agents and on and on using AI. ChatGPT says that it now has 180 million users. I can’t see why this won’t grow to be as big as Facebook, which has over 3 billion users. That said, the NASDAQ is about 7% off its highs as bond yields surged. Bonds and stocks compete, so this makes sense, high yields are drawing money out of stocks.

Companies left out of the AI boom will suffer the same way they always do when technology turns things upside down. This is as a story as old as railroads and canals. Remember companies like Kodak or Atari?

This leaves me thinking some stocks will go up a lot and other stocks will go down a lot. Stock indexes will be a net of these forces. Moreover, it will take a significant shock to get bond yields to go up further from here.

To be sure, the significant shock could be a full-fledged trade war. Trump comes into power Monday and if he is reckless, bond markets will get savaged. His advisors seem to know this. But will Trump listen? He seems like a person who would be attentive to this risk, but he is also unpredictable and can go into ostrich mode when the facts get ugly, as they did with COVID or losing the 2020 election. Stocks also fell sharply in his first term.

In other parts of the world, conditions look very different. The one that most catches my eye is Japan. The yen is at its weakest level ever, in inflation-adjusted terms. This is wildly bullish for their exports and also inflationary. In response to this inflation, Japanese bond yields are at their highest level since about 2010. Outside of Japan, most of the rest of the world is facing low inflation and will ease a lot, particularly China and Europe.

The fiscal spend is out of control. Either governments slash spending, or they raise taxes or technology is so deflationary interest rates plummet or they inflate away the debt. One way or another, something needs to give, soon. Brazil, France, and the UK are already in a “doom loop” of higher interest rates and higher debt service. This can spread.

Finally, we are in a “post-information” world. Now people get their information from innumerable sources, most of which aren’t vetted, be they Joe Rogan or Truth Social. This means there is no “objective” source of information left. Market prices are an exception. These prices are cold hard facts that we can use to see what is going on. I am paying close attention.

helpful perspective.

I agree with the "some stocks will go up a lot and some will go down a lot." I would say that the pace is likely going to be slow (before it gets fast). The reason why is I agree that AI is in its early-innings, and it tends to always work that way. It doesn't do much in the beginning—and incumbents might even benefit from the technology... before it sweeps over them.

If you look at how the Internet actually affected many companies, Google, Amazon, and the like only grew up after the DotCom bubble. It wasn't like the skeleton of what they became wasn't already existent. However, it takes time for models to be figured out (for Google to realize they could monetize ads in the way they did, or Amazon to spread out into every category and get Prime), and the current breed of AI companies haven't gotten there yet.

Commensurately, a lot of the newspapers were actually first thrilled that now they could, "get subscribers anywhere in the world." That was the view, at least before Google, Facebook, etc. came and essentially sucked their ad income stream dry. For streaming, it's taken a LONG time for the traditional broadcast companies to start dying and fighting with Netflix (and Prime) to move themselves into the new model (with only Disney and Disney+ likely surviving the transition).