This is a free post to give you a sense of what paid subscribers see. Writing these posts takes effort. If you value the content, sign up. Those funds help finance the research.

THIS IS NOT INVESTING ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

La historia era increíble, en efecto, pero se impuso a todos, porque sustancialmente era cierta.

Actually the story was incredible, but I impressed everyone because substantially it was true.

Emma Zunz, Jorge Luis Borges (1899-1986)

I write to you from Buenos Aires. Outside, a bright fall sun flits across the street. The climate and cafes remind me of Melbourne, Australia, minus the roving, cell-phone filching thieves on motorbikes. This is the land of, on the one hand, Messi, the current Pope and Borges and, on the other hand, successive governments with a history of murder, genuflecting to villains and outright theft. The new President, Javier Milei, claims he will break with the past. I came down to see what locals make of him.

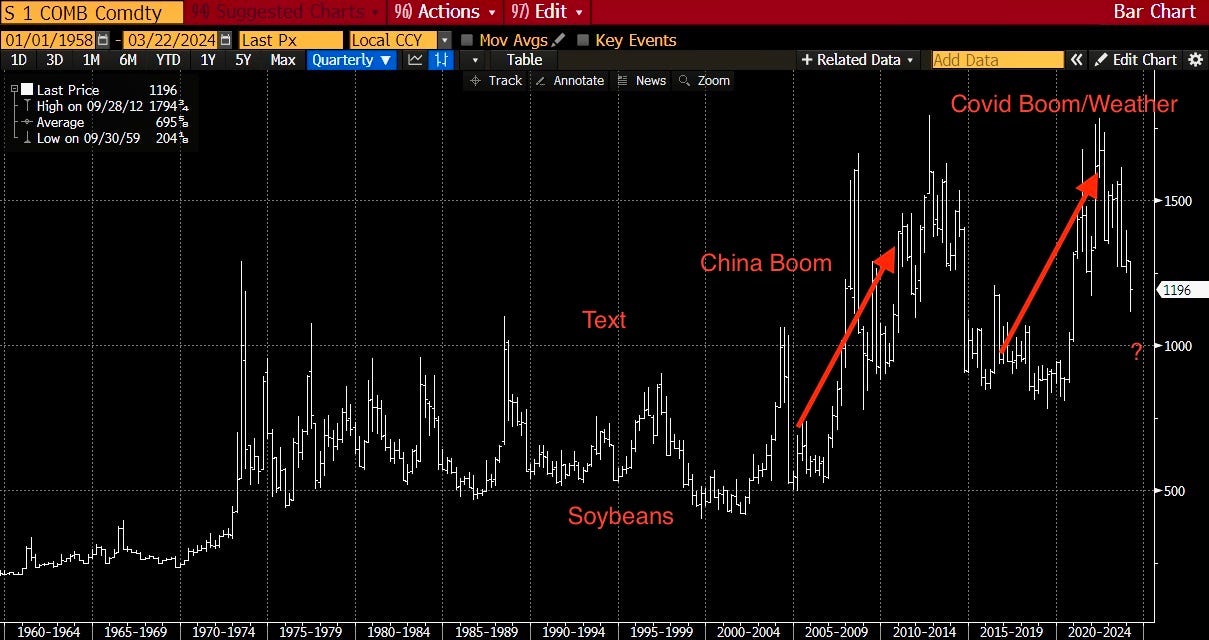

Like its neighbor Chile, Argentina possesses the ingredients to be a Latin Norway or Australia, all of them commodity rich. In fact, in 1913, Argentina was wealthier than France.1 Argentina is one of the few places on earth outside of the US, Brazil and Ukraine with soil so rich it can export food, in Argentina’s case soybeans, corn and wheat. Unlike the US and Ukraine, there are two growing seasons a year here instead of one. If it was well managed, this wealth could fund both generous social services for its 45 million people and create economic pre-conditions for growth in other areas, like outsourced IT. Instead, this country has teetered between something like a pre-euro Italy at its best or Venezuela at its worst.

Milei is a political outsider a la Trump and former economics professor who wants to eviscerate decades of state largess, currency controls, asset seizures, default and hyper-inflation and replace this with property rights and monetary austerity and hopefully a mind shift. Local investors love him. So far, his legislative program has met stiff opposition from Congress. Nothing has passed. Running for office is one thing. Leaders like Lyndon Johnson got things done because they mastered the legislative process; so far, Milei appears to have mastered Twitter.

He is a madman, he said so himself, said one person I met here, speaking approvingly of Milei.

The unions are pissed, and that’s a good sign, said another.

Mindset Shifts

Biden risks losing the election in part because grocery store prices are higher than when he took office. The US inflation rate is about 3%, plus or minus. Here it is clocking in at a cool 250%. If you have dollars, it is pleasant enough and things cost less then they do back home. But I also found myself the target of hungry, sometimes predatory eyes and watched a dumpster next to a place where I ate lunch get picked over by three different teams in an hour. The average salary here is a few hundred bucks a month, which means when prices rise this fast, the poor get screwed.

If stable prices are the goal, Argentina’s central bank is possibly the worst in the world, which seems at odds with a country with such a sophisticated, competitive agricultural sector. I kept asking how a place that feeds the rest of the world lack the competence to raise interest rates.

The Spanish/Italian/Catholic versus the Anglo Saxon, yes, there is something to that, one investor told me. Another marveled at a recent trip to Australia. He’d lightly scratched another car and the people around him made sure he reported it. No one would care in Argentina, he said.

How do you fix a pervasive mentality that views social contracts as conditional, a mentality that seems to have even infected the central bank? Given that most of the population voted for a “madman,” maybe when the costs to behaving this way becomes painfully obvious. Mentalities can indeed shift. I’ve seen it in Taiwan toward traditional Chinese authoritarian culture, in Ukraine versus the Soviet way and in race relations in the US.

An Argentine Crash Course

Since Argentinian wealth peaked about a hundred years ago, successive governments have gotten every major policy call wrong. For example:

1. Argentina see-sawed between military dictatorship and civilian rule. As a Harvard Business School study noted: frequent switches from military to civilian rule marked the period from 1955 to 1983. The periods of military control were 1955–1958, 1962–1963, 1966–1973, and 1976–1983.

2. Argentina, under Juan Peron, allied with the Nazis. This is a government that worked to shelter war criminals like Eichmann and Mengele from war crime tribunals. Getting the call wrong in the 1930s is bad enough. How can you be on the wrong side of history after the war?

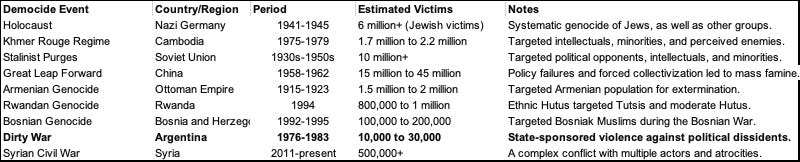

3. Argentina’s military dictatorship murdered tens of thousands during the last period of military control, ’76-’83. (This was also a low point for the CIA, which tacitly supported appalling human rights violations, as my podcast with John Dinges last year noted.) Compared to the worst democides in history, Argentina scores low on the list, but it is a horrific legacy that perhaps made parts of the population deeply skeptical of right-wing policies writ large, associating free prices with liberals getting tossed out of airplanes.

4. Argentina has a history of wealth-destroying populist initiatives. Under Peron (‘46-‘55 and again in ‘73) this was nationalizing railways and banks. Under the Kirchners (’03-’15) it was nationalizing the oil producer YPF, private pensions and defaulting on debt. When these seizures can be challenged in US court, the Argentine government loses.

These historical currents are inter-related in diabolical ways. The military hunting down and killing anyone with vaguely left-wing proclivities in the 1970s is related to paranoia over radical left wing policy. Like elsewhere in Latin America, the swings between left and right are extreme. I’m told the Kirchners were enamored of Putinism and where trying to create the same Putin, Medvedev term-limit two-step when the husband (Nestor) died.

Milei’s Opportunity

Milei has an opportunity. The population is hungry for change. One social scientist said he started noticing a shift in his polling a few years ago. Respondents were fed up with the chaos. Beyond a willing public, hyper-inflation reduces private sector debt to basically zero. You owed $100 but after 250% inflation the real cost of that debt is peanuts. Moreover, the population is so skeptical about the local currency that many have a stack of dollars and sometimes gold saved for a rainy day.

When my grandmother died, we found tiny rolls of dollars stashed all over her apartment, one person told me. The government has no room for cyclical stimulus, but every person does.

As a result, the banking system is starved of capital. If there was a Milei-inspired shift in confidence, it isn’t hard to imagine how:

a) households shift some of their dollars into pesos, and

b) they could then, as inflation and interest rates fall, borrow money and spend, creating a boom.

The question is Milei’s learning curve. He is both theatrical and, so far, absolutist. Even the IMF is saying he has gone too far. He needs to get his bills through Congress and garner the cooperation of governors, neither of which seem enthusiastic about his program. But Milei—-a fan of game theory and signaling—-is resolute he wants to starve the state to the point where his adversaries cave. He has kept last year’s budget unchanged and given that prices are up so much the entire state will run out of money in the relatively near future, a game of chicken.

Investment Implications

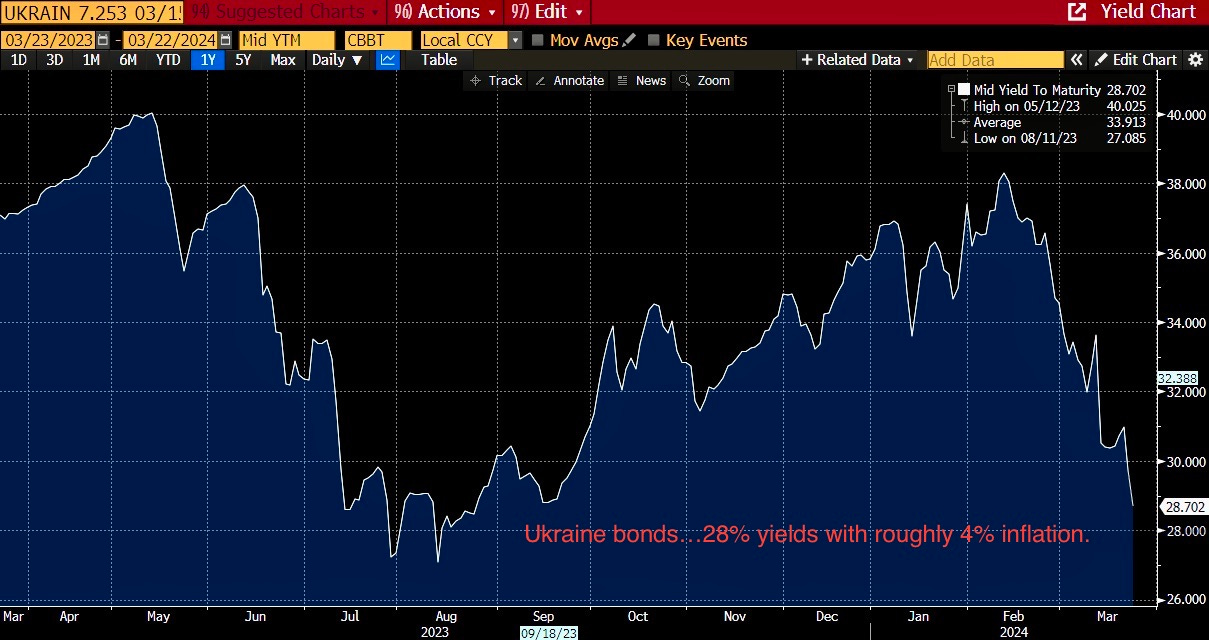

This reminds me of my trip to Ukraine last summer. Government bonds there were offering massive (10% ish) real yields. Clearly, if the West keeps supporting Ukraine and Kyiv fends of Russia, these bonds become an insanely good deal. I didn’t buy because I didn’t feel like I could forecast government policy in the West and so far that’s been the right call.

The yields are even higher in Argentina. People I spoke with here expect inflation to plummet. To me, however, this is an insider’s game, macro matters less than the political cycle.

The longer-term question involves China and soybeans. China is people-rich and land-poor, with about 20% of the global population but just a tiny portion of global farmland. This has made them net importers of soybeans, and they now consume around 60% of global exports. But a declining population and Xi’s focus on self-sufficiency may weaken that demand going forward, which will in turn weaken Argentina’s cash flows. To add to this, Milei has said he wants to cut ties with China because they are Communists! This would force Argentina to compete in other areas where they have demonstrated limited ability, like manufacturing and global services.

Norway and Australia—unlike most commodity exporters--have a culture that values rule of law and administrators that capably manage a commodity’s windfalls and declines. Sipping good coffee in a quiet café in the Palermo neighborhood here, it all seems tantalizing within reach. At present, however, you need to keep an eye peeled for guys on bikes that will steal your phone.

Typically, this is where I would tell my paid subscribers how I’ve moved my portfolio around. Given that this is a free post, I’ll hold off, except to say that I take what I’m seeing and translate it into action. If paid subscribers want to know about the logic behind last week’s tactical changes (I removed my hedges ahead of the Fed meeting) reach out. THIS IS NOT INVESTMENT ADVICE. DO YOUR OWN RESEARCH.

https://www.hbs.edu/ris/Publication%20Files/LAER%20Introduction%20to%20Argentine%20Exceptionalism_3c49e7ee-4f31-49a0-ba21-6e2b726cd7c5.pdf