If someone forwarded this to you, you can read about who I am here. I was a strategist and equity partner at the biggest hedge fund in the world. Now I make my thoughts available to you and implement them with my own capital. This Substack grows via word-of-mouth, so please forward to your friends. If you like this writing, you will enjoy my books Master, Minion, and Raising a Thief. This is not investment advice. Investing is risky and sometimes painful. Also, I’m going to take a few days off for the US holiday.

Quotes that caught my eye this week:

“It was Wormold’s day-dream that he would wake someday and find that he had amassed savings, bearer-bonds and share-certificates, and that he was receiving a steady flow of dividends like the rich inhabitants of the Vedado suburb.”

Graham Greene, Our Man in Havana, 1958

In 2002, the Sarbanes-Oxley Act was signed into law…GE’s ability to manipulate its reported profits was greatly diminished.”

Gryta and Mann, Lights Out, 2020

“Hearing that thing roar gets on my nerves.”

“Well then … kill him and stop his roaring…”

…“It sounds easy, doesn’t it.”

Hemingway, The Short Happy Life of Francis Macomber, 1936

As a species, we are programmed to focus on aberrations. Rubber-necking at a car crash or reading about a painful comeuppance after a plodding rise grabs our attention more than the steady flow of traffic or gradual compounding. Thus the decline in property prices in the US and China, in some places by double-digit percentage declines in a single month, got more ink than the steady climb higher.

Everyone worries about money. Real estate is a particularly tricky topic because

it is often bought on leverage,

the price is significantly driven by forces that have little to do directly with the property itself and

you can live inside it, which distinguishes property from every other form of money. You can’t live inside a checking account.

Last week, I zoomed in on Treasury Bills. Given the downturn in housing prices, today I want to focus on property. With time, we will cover all the major asset classes.

Leverage

Rare is the person who leverages their retirement portfolio 10 to 1. But in real estate, that’s regarded as normal. A 10% downpayment means you are levered 10 to 1 and if house prices fall 10% your equity is wiped out. In Oakland last month, prices fell 16%.1 Leverage is like electricity. It can make life much better but if you put your finger in the socket, you die.

Leverage allows you to spend thirty years of future income in a single day. On paper, on the day of the property purchase you will look richer (you now own more assets) but in reality are at your most financially vulnerable. You now owe thirty years of spending (or however long your loan is) forward and who has 30 years of visibility into their future income? The typical US household has $140,000 in assets, most of it in housing and held with leverage.

Given this leverage, real estate is highly sensitive to interest rates, which means it is highly sensitive to the bond market, and few understand the bond market. Below I show the 15-year mortgage rate against US home prices. Note the 2008 downturn in prices and now, after a massive spike in mortgage rates, the most recent kink down in prices. The presenting problem, as a doctor might say, is the cost of credit. The picture is even bleaker for commercial real estate in major US cities, crushed by a combination of higher interest rates and work-from-home. This is not isolated to the US. In China, real estate prices have been sliding for two years, a separate story I’ve covered elsewhere, and in Europe property prices have stopped rising but are not yet falling.

The ignorance about how the bond market works is true even among finance people. For instance, Jamie Dimon, the CEO of JP Morgan, said earlier this week that both a) interest rates are going to go up and b) banks are cutting back on credit. The two comments are logically inconsistent. Tightening credit is bad for growth and thus good for bonds, meaning interest rates decline. Dimon is a former management consultant, not a bond trader.

Said differently, if you are making a bet on real estate you are in part taking a huge bet on bond prices. Lower yields are bullish for real estate and higher yields can be very bearish for the simple reason that people can buy more with lower credit costs and less with higher ones. That’s not the only thing that drives real estate prices, but it is a big thing and, as Subscribers will see in my case studies, important for deciding if real estate is a good investment or not.

Silos

When I was a banker, one of my strongest impressions was how the company was divided into silos. The “rate” guys (interest rates and, yes, it was mostly guys) almost never spoke with the people raising equity. The one person who traded gold didn’t talk to rate guys. Commercial real estate lending was on a different floor. Academic training is similar. By and large, economists don’t talk to the neuroscientists or the artists.

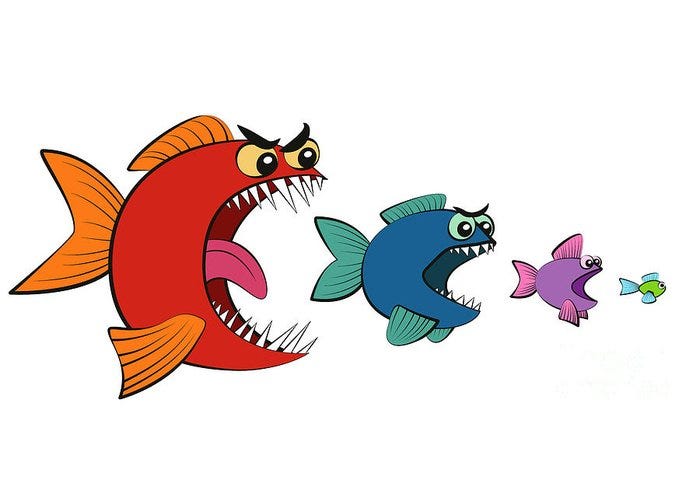

Siloed thinking may be rewarded in a corporation or school but it is terrible for investing. This siloed thinking may also explain why my bank (BankBoston) did so many stupid things that it was eventually bought by another bank (Fleet), which was then bought by another bank (Bank of America), whose CEO (Ken Lewis) fired most of us and then, in turn, Ken did something so dumb (buying firms around the financial crisis) he was fired, fined by the New York Attorney General (Cuomo) and barred for three years for holding an executive position at a public company. Cuomo was later fired for sexual harassment. The entire System looked like this.

Image: Imgflip

We are the small green fish in this “System.” This is why it pays to step back and think about how things fit together and I mean “pays” quite literally. Even though you aren’t trained this way, you need to train yourself this way. Or rather, you can not think this way and suffer the consequences or do the often difficult work of trying to stitch together the big picture.

Property Moving Parts

When it comes to real estate,