THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Tariffs are terrible.

They simultaneously make government more intrusive, boost costs, narrow corporate margins, invite countermeasures and will almost certainly whack the stock market, creating a negative wealth effect.

If tariffs are bad for the global economy and don’t fix any obvious problem, why implement them? The best answer I have is that, no, this is not about fentanyl. Instead, tariffs focus attention on Trump. That’s why the cameras are rolling when he signs executive orders. It is here where his authority is unchecked. To adjust taxes, he (for now) needs Congress. Not so for tariffs.

In 20-plus years of investing, the most important thing to figure out was if growth and inflation were rising or falling and how central banks would respond. Many other variables matter and markets are complex, but at the highest level discounting, growth, inflation, and monetary policy are central. Now I need to make a further adjustment to my rubric—what will Trump do? He is erratic and enjoys drama. He can rescind the tariffs as fast as he implements them. While his effort to enforce the border, dismantle woke, and make the government more efficient is broadly popular, tariffs will hurt his base.

We moved away from tariffs after the Great Depression, which was caused by tight monetary policy via a rigid adherence to the Gold Standard. The solution for trade imbalances that Trump supposedly dislikes already exists and is market-based—a flexible exchange rate. The idea that the White House can figure out what tariffs to assign to whom is straight out of Gosplan, the Soviet planning bureau.1

Tariff Precedents

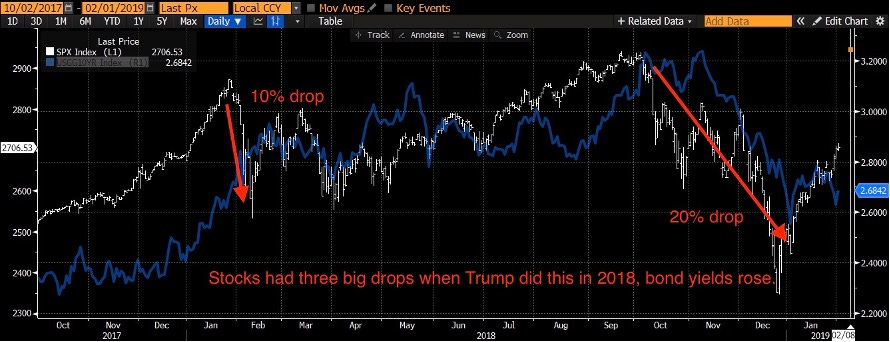

When Trump did this in 2018, the tariffs were more targeted, focusing on dishwashers, solar panels, and steel. These tariffs are broad-based. The market impact in 2018 was clear—stocks down, bonds down, as you can see from the chart below. Stocks had three drops, two of them double-digit. Bond yields rose until the stock market tanked, at which point they began to decline. (The parallel isn’t precise because the Fed was initially raising rates at the time, while now it is discounted to ease.)

Yields up, stocks down, and then yields down is the logical response. Higher prices are initially inflationary, negative for bonds, which in turn is negative for stocks. Moreover, investors will have difficulty guessing how earnings will shift amid threats and countermeasures so some investors might step aside. The Congressional Budget Office also estimates that tariffs will slow GDP, perhaps significantly. That is also stock bearish as earnings will decline.

Add to this that the discounting on stocks is more extreme now than it was in 2018. There is no equity risk premium. The bond yield is 4.5% and the earnings yield is … 4.5%. These metrics are not helpful in predicting one-year equity returns but they do suggest stocks are not cheap and vulnerable to a shock, which Trump just delivered.

Dark Triad Personalities

If it’s not about fentanyl, what is it about? Understanding Trump’s motivations require looking beyond economics. While I am not a psychologist, it is invaluable to have a rudimentary knowledge of how psychologists categorize personalities and how that might apply to current global leaders. I was forced into this understanding, which I described in my first book, Raising a Thief.

Trump is representative of what psychologists label the “dark triad.” The term is based on a 1998 paper by John W. McHoskey, William Worzel, and Christopher Szyarto entitled “Machiavellianism, narcissism, and psychopathy: Differentiating the Dark Triad.” The authors look at the overlap between these three personality types and establish an archetype. Dark triad personalities are often charismatic and offer grandiose visions and are also manipulative, deceptive, have thin egos, and a propensity to break rules, including the use of violence. Simultaneously outlining a bold vision of American renewal, constant lying, releasing the January 6 rioters, and now breaking trade agreements fit well within this personality type.

To be clear, it is not that unique a personality. Putin and Xi share characteristics of this too. Invading Ukraine with no thought of the cost to Russian soldiers and Ukrainian civilians is dark triad, as is Xi locking up millions in an endless anti-corruption probe. All three leaders adhere to philosophies that were thought to have died. In Putin’s case, it is land seizures, in Xi’s case it is faux-Maoism and in Trump’s case, it is 19th-century economic policy.

I wonder if the technology-driven economic volatility is disruptive enough that, collectively, each society is yearning for a strongman. My biggest impression when I walk around any part of the world is that we have a new baseline behavior—staring at our phones, which is representative of how technology has radically shifted our behavior and perception of the world. It’s worth noting both Putin and Xi have been terrible for their respective capital markets. Investors like rule of law and predictability.

Reverberations

In addition to disruptions inside their respective countries, these personalities fight one another, another variable an investor needs to consider. Don’t believe for a moment in a partnership between Xi and Putin. Xi endlessly criticizes Britain’s 19th-century China policy, but it was Russia that obtained large chunks of Chinese territory during this era and this has not been forgotten.

The clash between the US and Russia and China is known. I wondered if the story about DeepSeek was encouraged or even organized by Zhongnanhai, the Chinese leadership, as part of an effort to keep Trump and the US administration off-balance. Putin has indicated that he will not negotiate in Ukraine unless Trump takes a harder stance against the Kremlin.

What’s next is multi-dimensional. If stocks tank, Trump may reverse course on tariffs. Then there is Taiwan. Xi will be looking to see how Trump deals with Putin in Ukraine. If the US agrees to Putin’s demands to steal Ukrainian territory and cede its sovereignty, China takes Taiwan. Both Xi and Putin likely look at Trump’s claims on Greenland with approval. If China takes Taiwan, the 2018 drawdown in stocks will look like a modest ripple.

For now, I have to navigate the tariffs. One thing at a time. This is not a buy-and-hold market. It’s the type of environment I described in my last book, The Uncomfortable Truth About Money. What’s a safe investment now is shifting and unstable, we will see waves of panic and relief.

This document is strictly confidential and is intended for authorized recipients of “A Letter from Paul” (the “Letter”) only. It includes personal opinions that are current as of the date of this Letter and does not represent the official positions of Kate Capital LLC (“Kate Capital”). This letter is presented for discussion purposes only and is not intended as investment advice, an offer, or solicitation with respect to the purchase or sale of any security. Any unauthorized copying, disclosure, or distribution of the material in this presentation is strictly forbidden without the express written consent of Paul Podolsky or Kate Capital LLC.

If an investment idea is discussed in the Letter, there is no guarantee that the investment objective will be achieved. Past performance is not indicative of future results, which may vary. Actual results may differ materially from those expressed or implied. Unless otherwise noted, the valuation of the specific investment opportunity contained within this presentation is based upon information and data available as of the date these materials were prepared.

An investment with Kate Capital is speculative and involves significant risks, including the potential loss of all or a substantial portion of invested capital, the potential use of leverage, and the lack of liquidity of an investment. Recipients should not assume that securities or any companies identified in this presentation, or otherwise related to the information in this presentation, are, have been or will be, investments held by accounts managed by Kate Capital or that investments in any such securities have been or will be profitable. Please refer to the Private Placement Memorandum, and Kate Capital’s Form ADV, available at www.advisorinfo.sec.gov, for important information about an investment with Kate Capital.

Any companies identified herein in which Kate Capital is invested do not represent all of the investments made or recommended for any account managed by Kate Capital. Certain information presented herein has been supplied by third parties, including management or agents of the underlying portfolio company. While Kate Capital believes such information to be accurate, it has relied upon such third parties to provide accurate information and has not independently verified such information.

The graphs, charts, and other visual aids are provided for informational purposes only. None of these graphs, charts, or visual aids can of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

While there may be a narrow case to make for tarrifs against China given a managed exchange rate, there is no broad case to make against Mexico, Canada and Europe.

I thought of adding Trump to the list but wanted to limit it to current political leaders. Much will come down to the behavior or people we don't know. That's why Trump was unable to overturn the 2020 vote, despite his best efforts. Will the Senate apply a brake? So far, there is not much sign of that.

Maybe add Musk to your list. I wonder how intelligence interact with these traits. Xi and Putin have been able to consolidate power for a long time... hard to argue they have not done well for themselves. Musk has done well for himself... he isnt Gengis Khan, but he will probably have over 40 kids by the time he is uploaded to the cloud and maybe hundreds more after. I'd guess Trump isn't as smart as this cohort... maybe he fails/break things more thoroughly. In liberal democracies smart people with these traits could win by strategically cooperation/playing win-win strategies a lot of the time and appearing to be virtous. The willingness to openly show your true colors (i.e. blatant corruption via things like Trump Coin) is not a good sign. Markets are pricing this as upside... a proto fascist pro business regime as being good. Maybe that is right. But the downside that post World War II america-led win win world is over is not discounted.