THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Today, I want to share a podcast, a China update, and discuss the D.C. fiscal/monetary standoff.

Podcast

Bill Bishop writes the Sinocism Substack. I find reading Bill’s missives helpful in keeping me on top of what is going on in China and wanted to hear his story, which I think you will find interesting as well. This relates to the second topic, what will happen in China?

China

China is the second biggest economy in the world and because the volatility of its growth is higher than the volatility of US growth, is more important than the US in determining the swings in growth. There are a number of assets that are cheap … if China rebounds. But these assets, like commodities and the stocks of companies whose earnings are significantly influenced by China, are traps if China doesn’t solve its challenges. It’s also true deflationary pressures globally will intensify if China continues to struggle. That’s important for monetary policy everywhere.

To put numbers around the problem, China is a $19T economy with roughly $8T of bad debt, mostly tied to real estate developers and local governments. Defining what exactly “bad” is isn’t straightforward; a debtor who is having trouble repaying their debts qualifies. Once the debt is bad, the economy can freeze. The debt is a contract that then needs to be re-negotiated or defaulted on. This is the same thing that happened in the US in 2008. A chunk of income goes to servicing the debt, hurting demand. Corporate profits in China are declining, down 7.5% in November from a year ago, which reflects this freeze. This is self-reinforcing and it only breaks when the government (which is the only entity that can still meaingfully borrow) borrows, prints and both weakens its currency and buys back the bad debt. It’s less ideology than physics. From what I can tell, China is not doing this. While there are a lot of policy actions, nothing seems to be tackling the debt issue in its entirety.

A system like China is different than Western systems. Power is concentrated versus dispersed. For instance, even with Republicans in control of the US White House, Congress, and Supreme Court, Trump has been buffeted. Gaetz didn’t get through, and neither did abandoning the debt limit. In China or Russia, one person controls everything. Sometimes this person is more liberal—like Deng Xiaoping or Gorbachev, and these places evolve. Sometimes this person is more conservative—like Stalin and Mao or Putin and Xi, and these places stagnate or go backward. When Xi was told his policies would produce deflation (which makes the debt squeeze worse), his answer supposedly was, “what’s wrong with that?”

That evidence suggests an authoritarian leader is doing a bad job often has little bearing on policy. Putin is killing a significant chunk of his own population (not to mention Ukrainians), and he shows no signs of letting up. Ditto Stalin and Mao, who oversaw the most costly man-made starvation in the history of governance. While I see lots of cheap assets tied to China’s growth, I can’t bring myself to buy them. It looks like bad risk/reward.

The US Monetary Fiscal Battle

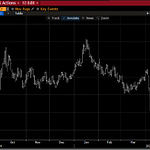

When I look at the set-up going into Trump’s reign, it is also complicated. Stock valuation is high, the market is long, the budget deficit is 6% and the Fed is discounted to cut just one more time. The best aspect of the setup is that bond yields have risen 100 basis points and are now close to the top of their range.

Underneath the surface, a battle is underway. The White House agenda is tariffs and tax cuts. If Trump brings on these policies on day #1, I suspect we get a bond sell-off that is big enough to whack the stock market, possibly hard. The Fed will be reluctant to cut interest rates given that these policies are in part inflationary. They said as much earlier this month.

If Trump surprises, however, he will come out with efforts to reduce the budget deficit and cut taxes only for the middle class, not rich people. He could also talk about tariffs but not implement them. Those policy choices, plus slowing growth and inflation, would give the Fed room to cut interest rates, which can fuel another up leg in the stock market. Said differently, to get what Trump wants—a boom—he needs to give up on something else he wants—tariffs and tax cuts. I’m skeptical he will make this pivot unless the financial markets fall apart.

Trump is both powerful and unpredictable. He ran on policies not that different than Richard Nixon—law and order, strong growth, and reducing foreign entanglements (then Vietnam) with dignity. But what will Trump 2.0 mean in practice? Is he anti-immigration (Maga) or pro-immigration for hi-tech workers (Elon)? Is he for big tax cuts or reigning in wasteful spending?

It’s worth remembering that Nixon was responsible for one of the biggest financial shifts in the last 100 years—the end of the Bretton Woods system of fixed exchange rates. This did not come up in his campaign, of course. Could we be in for a change that dramatic? Maybe. A dollar devaluation would certainly spur growth and the dollar is at its highest level in real terms in decades. My plan is to wait for hard facts and adjust accordingly, perhaps substantially.

Happy New Year, and thanks for reading. I am taking a few days off in the beginning of the year, so will get back to you later in January.

Share this post