THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

There are about 45,000 Russian casualties a month now in Ukraine. That equates to a rate of 540,000 soldiers per year or about 1% of Russia’s male, fighting-age population, thus the call to North Korea to supply troops. About 15% of Russia’s population died in World War 2, so today’s losses are modest in comparison but by modern standards an incomprehensible cost for territorial gain.

Almost all of those who die come from Russia’s hinterlands. An American equivalent would be if the Pentagon emptied US jails, drafted from the poorest zip codes, sent them to attack Canada, and then gave generous cash packages to the next of kin. Some provincial Russians have even welcomed the war because the poorest, most alcoholic locals have been disposed of and replaced with a cash subsidy.

The question is if President-elect Trump will view Putin’s negotiating position as strong. I don’t know the answer. I do know Trump’s answer has vast implications for geopolitics. China is weighing Taiwan, Iran is weighing its tactic of spreading death and chaos in the Middle East. This also matters for US government finances, bond yields, and equity valuations.

Today, I want to talk about the policy choice and financial implications and also share a conversation I had with Lt. Gen (Ret) HR McMaster, Trump’s former National Security Advisor. He offers a perspective I lack and I am grateful he made the time to talk with me and allowed me to share that conversation with you.

US Policy Decision

While Republicans control the White House and Congress, there are splinters within the Party. Some are isolationists, others are internationalists. HR does not share his affiliation but he believes the US can be a force for good. If someone like Musk wants to cut government spending, he needs to slash either social security, medicare, or defense. Slashing defense would narrow the US budget deficit and be a radical restructuring of the global order.

But such a sharp jag is off-brand for traditional Republicans. A report by Senator Wicker (R. Miss) is making the rounds. It is titled “Peace Through Strength” and is clearly meant for Trump’s desk. Below is an excerpt. I put the key sentence in bold.

America’s national defense strategy and military budget are inadequate for the dangerous world in which we find ourselves. An emerging axis of aggressors is working to undermine U.S. interests across the globe. Congress and military leaders agree: The United States has not faced such a dangerous threat environment since the years before World War II.

The epicenter of this test is Ukraine. Regardless of Party, US Presidents have not wanted to deal with Russia for the last quarter century. It’s far away, has almost no economic relationship with the US, and is highly corrupt. But time and again, US Presidents have been forced to focus on Russia in a way that has sometimes sabotaged their domestic agenda. Could this happen to Trump 2.0?

Context

Putin took over on December 31, 1999. Not long after problems began developing and each US President sought their best to ignore them for the same reason—they didn’t want to engage in conflict. However, this has only allowed the situation in Russia to metastasize. This echoes the same process that unfolded in Germany in the 1930s, so Wicker’s comment is apt. While Russian assassinations at home and abroad began early in Putin’s reign, the key events where the US whiffed was when:

Russia annexed parts of Georgia under President Bush in 2008.

Russia annexed Crimea in 2014 under President Obama.

Russia fired on Ukrainian ships in 2018 traveling between Ukrainian ports under President Trump.

Russia invaded Ukraine in 2022 under President Biden.

In each case, the response was bumbling and timid. Note that Russia and the US both signed the 1994 Budapest Memorandum whereby Ukraine gave up its nukes in return for its borders being secured.

While it sounds extreme, I don’t think it is a stretch to say that this is the 1930s with Putin playing the role of Hitler and the US playing the role of UK’s Neville Chamberlain. Russia has slowly been swallowing more territory, violating international law, and threatening the West with nuclear war if the West intervenes. The assassinations on Western territory continue. Just last week, the UK foiled a Russian plot to murder investigative journalist Christo Grozev. If Putin isn’t stopped in Ukraine, I believe he will move on, possibly to the Baltics.

Fiscal Implications

The US budget deficit is currently at 6%, even as the economy is strong. This is unusual. The only solution to narrow the deficit is by raising taxes and cutting spending. The solution isn’t conceptually complicated but it is politically toxic.

But what will Trump do? From what I can tell reading McMaster’s books, Trump is conflicted. He wants to appear “strong” and also hates foreign entanglements. His ideal environments are neater, like Trump Tower or Mar a Lago or a golf course he owns. If he were to quickly sign a peace deal with Putin, I suspect Trump would look weak. But Ukraine is exactly the type of mess he wants to avoid.

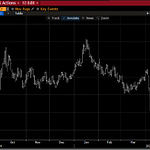

To deter Russia, the US is going to need to spend a lot of money. McMaster said he thought the US defense budget needed to go from 3% of GDP to 5% of GDP. Without tax hikes, that would drive the deficit to 8% of GDP and possibly drive bond yields to 5% or 6%. This then would hit the stock and housing markets.

Since Trump got elected, US bond yields have fallen. It’s interesting and counter-intuitive unless one thinks a significant adjustment in government spending is coming. This is also a bet that the Fed will cut rates later this month, of course.

To be sure, If the Fed were strictly following an inflation mandate, they would not cut. Inflation in the US is around 3%. The target is 2%. The last major inflation print of the year comes out next week and is expected to be 3.3%. Trump confronting Putin is not in anyone’s expectations. But if he goes down that route, it certainly is not priced into markets.

Share this post