I cannot sleep.

Tonight it seems impossible that anyone sleeps. How can they?

My blood aches.

History of the Rain, Niall Williams, 2014

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Today I want to share a podcast and talk about China.

The podcast is with Hamish Norton, the President of Star Bulk Carriers, which operates a fleet of dry bulk carriers. That means his company dispatches some of the enormous ships you see off on the horizon carrying wheat, iron ore and bauxite. The conversation is timely given China’s aggressive policy intervention this week.

I asked Hamish what routes are particularly profitable for Star Bulk and he cited a route shipping iron ore—used for making steel—from Brazil to China. This caught my ear. Australia also has iron ore, but is closer to China. Moreover, China is in the midst of a real estate bust, thus less construction and sharply lower demand for iron ore (ergo the policy action). Hamish’s answer: China sees Australia as tightly aligned with the West, while Brazil isn’t, so Beijing would rather do business with Lula. In addition, building up China’s Navy requires an enormous amount of steel. So what once went into the real estate is now going into aircraft carriers, which is great for Star Bulk.

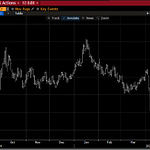

This is fascinating in its own right but directly relates to China’s policy pivot. The market is treating China’s round of stimulus as a game changer. Chinese stocks are up 15% in the last week, as you can see below. Rather than being meaningful stimulus, I’d instead describe it using a Russian word, Maskirovka, or disguise. It is a rather expensive disguise, to be sure, but it is distracting from what is really going on.

The key issues facing China are:

Xi’s Maoist-light style of leadership and

A deflationary de-leveraging following China’s real estate bubble

In terms of policy, this week the Chinese:

modestly cut interest rates including the policy rate, mortgage rates and bank reserve requirements

lowered required mortgage downpayments

set up facilities to allow companies to more easily buy back stock and

said they would set up financing to complete unfinished buildings

Seeing the last item, copper rallied 15% this week on expectations of a surge in construction activity. The key question is do the policy announcements solve the key issues. My answer is: no.

Regarding the style of leadership, the same week Beijing unveiled this intervention, a leading economist, Zhu Hengpeng, disappeared for raising questions about the effectiveness of China’s economic policies. A lot of people are disappearing, well over a million. This is the core reason why people do not want to take risk. China’s big banks have plenty of capital, but people don’t want to borrow it because they are scared. Recall that the Cultural Revolution only ended when Mao died in ‘76, so the trauma of arbitrary detention is very fresh.

Moreover, we don’t know how big the bad debts are in China, but they are likely large. I’ve walked through one of the Chinese ghost cities myself in Tianjin. It feels like walking onto the movie set of a post-apocalyptic world. Imagine lower Manhattan … empty. It’s eerie. In 2008, US real estate losses were around 20% of GDP. That suggests total losses in China are in the $4 trillion to $6 trillion range, assuming their crash is as bad as the US’s was. It might be worse. This means China would need to force around $800 billion to $1 trillion through the banks (assuming the banks would lever this money up) to buy the bad assets once their prices fell far enough. Absent such an intervention, households will save more, spend less and nominal GDP will gradually grind lower, making debt service ever more painful.

I have heard from contacts inside China that apartment prices in tier 1 cities, like Beijing, are down 40%. What are the actual figures? We don’t know and if you raise questions about it inside China, like the economist, you disappear. The market action is also telling. While stocks rose, so did the currency, the RMB. This is not what you want to see. If they were meaningfully easing, the currency would go down as the yen did when Japan finally dealt with its bubble. A higher currency reflects a shortage of cash, not an excess.

What does seem to be eating up a lot of resources is military preparedness. Publicly, China’s military spending is a fraction that in the US. But if one were to carry Hamish’s fact forward, it would suggest something much more significant underway and that the stock market intervention is not the big story. This is one of the key indicators Churchill used to anticipate German rearmament. Yes, there are companies that will indeed buy back a lot of stock, and some of these companies may rally quite hard. But the central story is a different one than what you are reading in the headlines this week. Xi is carrying out his program and falling stock prices were an unwelcome obvious indication that private sector investors don’t like these policies. Just like the economist disappeared, Xi wanted the stock market action to disappear as well.