Inside and outside at the same time. That is the key.

Richard Koo

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

I read Richard Koo’s books years before I spoke to him, a conversation I share here. Richard is the first person I know to provide a comprehensive diagnosis for something evident across much of the world—weak borrowing. While many people have the capacity to borrow money, most don’t. Explaining this phenomenon is interesting in two respects. First, the propensity of the private sector not to borrow much impacts the price of many things dear to us, like stocks, bonds, and real estate. Second, Koo came up with the idea by looking at the same data as everyone else but arriving at a different, more insightful solution.

Creativity is exactly that—looking at the same thing as others but seeing a different answer. I asked Richard why he thought he was able to spot something everyone else missed. His answer was that he was an outsider and an insider at once. He is Taiwanese but speaks fluent Japanese. He was inside Nomura Bank but inside the think tank, not the trading floor. He was at the US Fed, but his formative experiences were in Asia. That’s a rare combination and while being an outsider doesn’t always feel nice, it does hone the talent of observation.

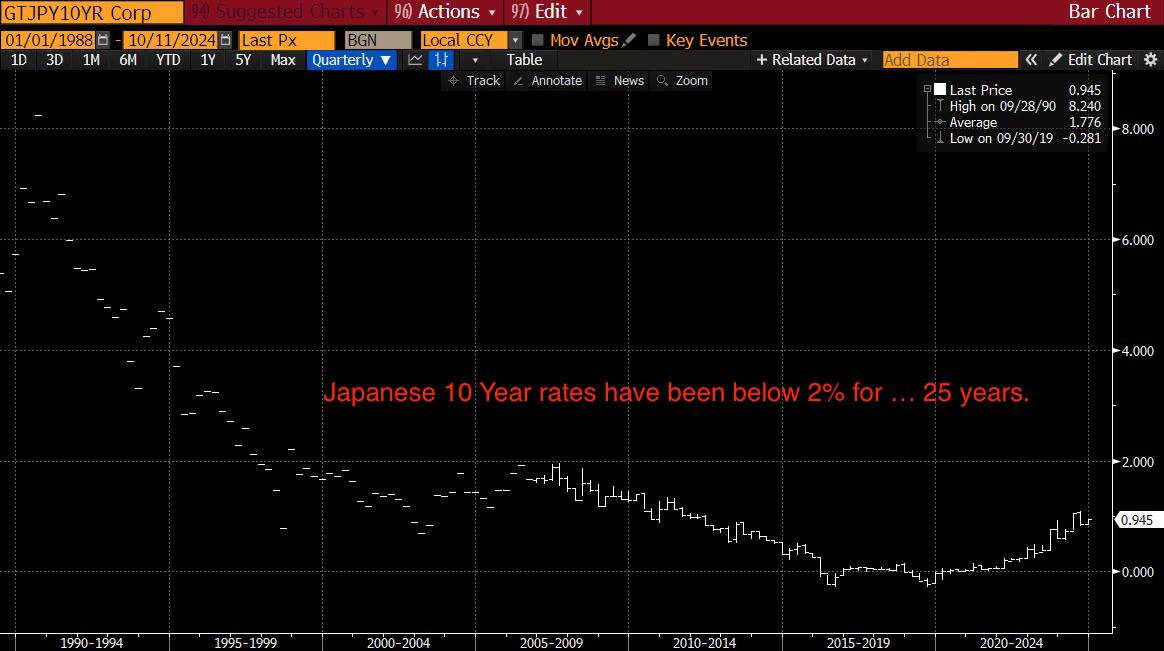

His framework explained something I first noticed in the 1990s. I was standing on a trading floor in Boston talking to our $/yen trader. On his desk, he had a Japanese newspaper advertising a 30-year mortgage at 1.5% or thereabouts. I knew interest rates in Japan were low but seeing that number was a shock. Why wasn’t everyone levering up to buy a new house? If house prices rose a few percent a year, you could borrow for free, right?

But it isn’t that simple. The tricky thing to understand about economies is how many economic relationships are self-reinforcing. For instance, if people don’t want to borrow, then interest rates are low, and real estate prices are depressed, which leads to people not wanting to borrow, which keeps interest rates low. In slightly different language, both Soros and my old boss Ray wrote about this.

Richard talks about a “balance sheet” recession. It’s an odd but powerful concept. The essence is that a borrower is cash flow positive but balance sheet negative, such that they use their cash to pay down debt, not buy stuff, which then leads to widespread economic weakness, which then leads to worse cash flow. Everyone is thrifty at once, which makes the pie shrink, which forces everyone to be yet more thrifty. John Maynard Keynes coined the term the “paradox of thrift” in 1936 after the Great Depression.

In Japan’s case, the 1990 real estate bubble left the corporate and banking sectors with terrible losses, which they slowly tried to pay off. But their frugality meant the economy was so weak they were caught in a trap. The only solution was that someone needed to spend big to get the economy to operate above potential, generate inflation, and boost nominal incomes such that debt burdens fell. That only began to happen after 20 years, in 2010, when the Bank of Japan printed a lot of money and the yen slowly weakened.

In 2008 in the US, the same thing risked happening. But this time the central bank chief was Bernanke who had studied the Great Depression and knew exactly what to do, which was force money into the system. He printed money and bought bonds and shoved dollars into bank balance sheets such that they were forced to lend it out because the interest rate on their balances dropped to zero. The Japanese mimicked his policy and are now doing much better.

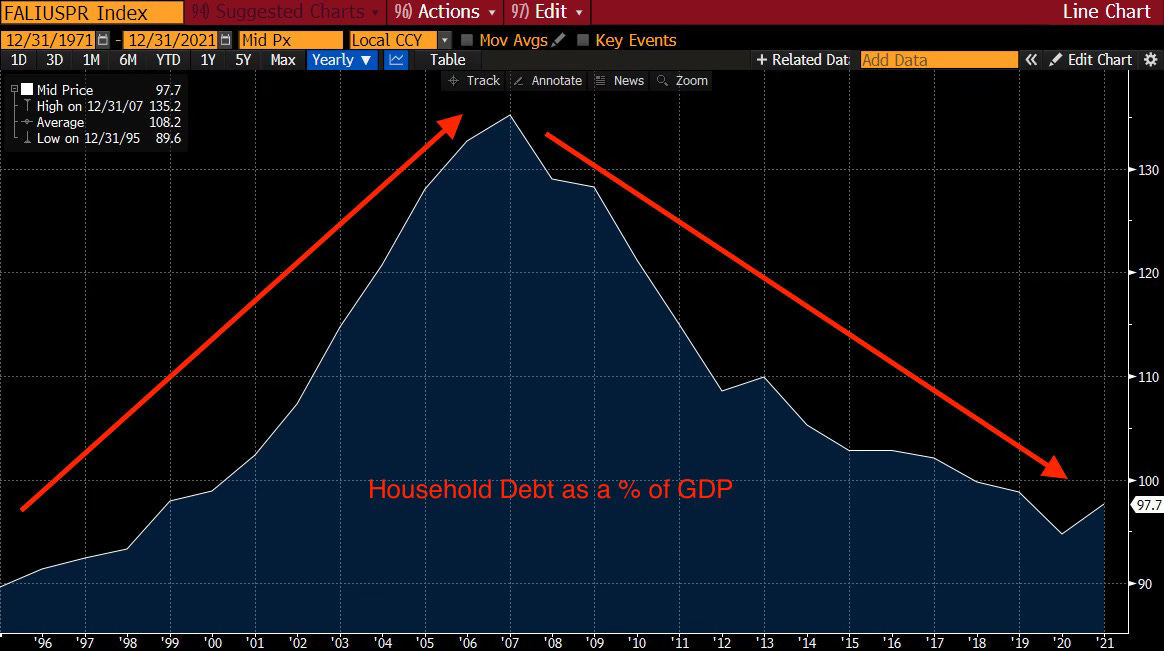

Yet years after the 2008 real estate crisis, US household debt as a percentage of GDP is still falling.

The long tail of financial crises is profound. I believe China is going through the same thing now, which is why I have so little confidence in the measures Beijing has announced. As I’ve said before they are addressing symptoms—falling stocks and bond yields—not the cause, at least so far.

Which brings me to the US and the forward-looking picture. Inflation is a function of supply and demand. On the demand side, I suspect private-sector borrowing will remain weak, limiting overall demand. On the supply side, we are in an era where technology makes itself profitable by finding a way to do something bigger for less cost. In recent decades we have a) turned goods prices into deflation b) now are disrupting real estate due to remote work and c) going-forward are just scratching the surface of what we can do with services. Japan is less an outlier than the template. The pandemic inflation was the outlier.

Yes, immigration and wars can disrupt this deflationary picture and there may be World War 3 with the epicenter in Asia. A paper about that topic is evidently circulating in China now. It is a terrible thought to contemplate but within the range of expectations. Absent those forces, however, deflation almost certainly has the upper hand and Richard Koo’s work helps explain why.

Other updates:

My previous podcast was public but the post I shared it in was not, so it didn’t hit Apple and Spotify podcast feeds, a glitch of Substack. I will re-release the podcast so don’t be surprised when it shows up in your inbox.

Kate Capital LLC goes live next month and for now I want to pause the payments I receive from Subscribers. I can only do so many things at once. I will continue to write, but won’t share my asset allocation and performance publicly.

I’m watching the price action and two things stand out. First, skepticism about China. Second, the market betting Trump will win. That’s my simplest explanation of why US bonds have been selling off. Trump has said he will cut taxes and boost tariffs. That means bigger budget deficits and more inflation, which is bad for bonds. It’s that simple.

Copies of my latest book, The Uncomfortable Truth About Money, arrive on my doorstep today and in bookstores next month. I look forward to sharing the book with you.

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.